Sentiment: Bullish

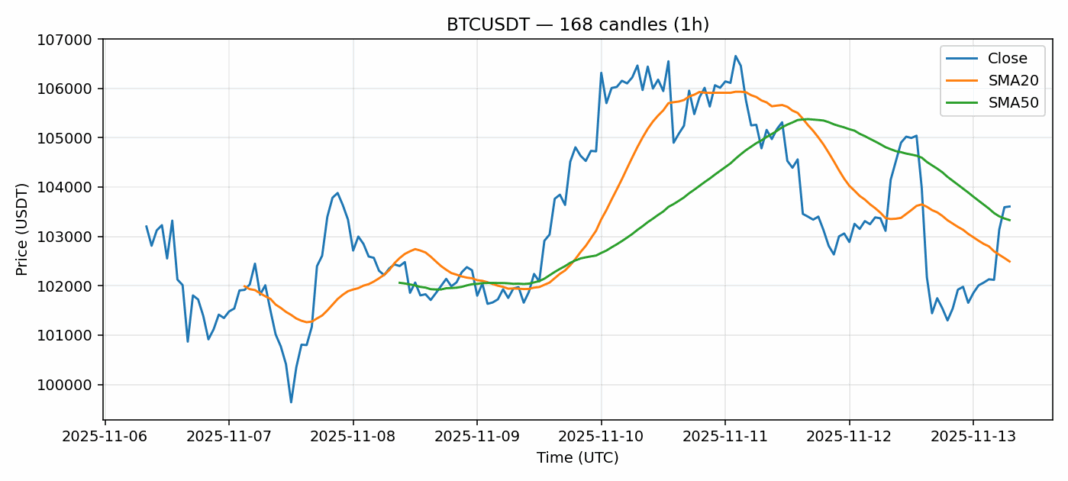

Bitcoin continues to show impressive momentum, trading at $103,605 with a solid 2.39% gain over the past 24 hours. The current price sits comfortably above both the 20-day SMA ($102,491) and 50-day SMA ($103,330), indicating underlying strength in the bullish trend. However, the RSI reading of 77 suggests we’re entering overbought territory, which typically signals potential for a short-term pullback. Trading volume remains robust at $2.35 billion, supporting the current price action, while volatility sits at a manageable 2.2%. Traders should consider taking partial profits on existing long positions and wait for a healthy retracement toward the $102,500 support level before adding new exposure. Strict stop-losses below $101,800 would be prudent given the elevated RSI levels. The overall structure remains bullish, but caution is warranted near these technical extremes.

Key Metrics

| Price | 103605.8200 USDT |

| 24h Change | 0.24% |

| 24h Volume | 2354203016.18 |

| RSI(14) | 77.09 |

| SMA20 / SMA50 | 102491.46 / 103330.04 |

| Daily Volatility | 2.20% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).