Sentiment: Bullish

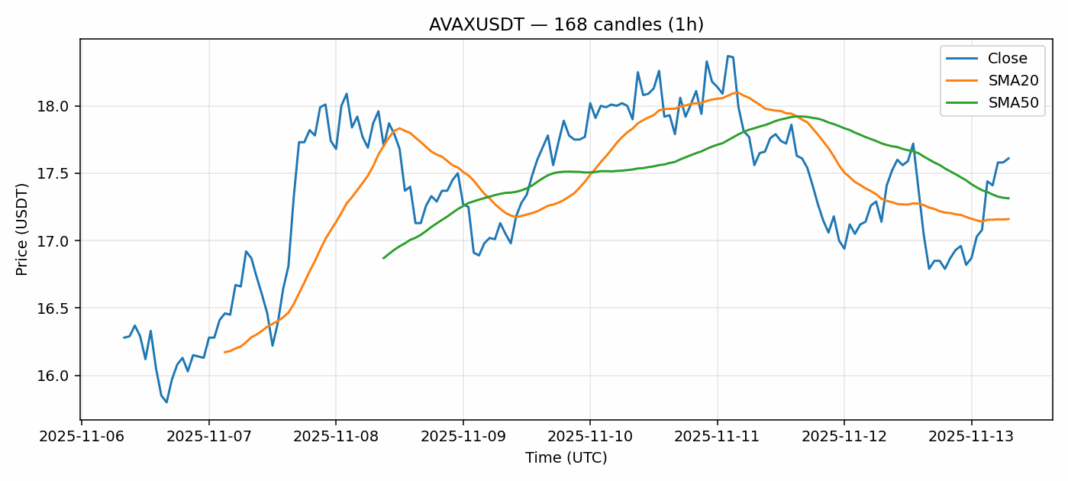

AVAX is showing impressive momentum, trading at $17.60 with a solid 1.85% gain over the past 24 hours. The current price sits comfortably above both the 20-day SMA ($17.16) and 50-day SMA ($17.31), indicating strong underlying bullish pressure. However, caution flags are waving with the RSI reading of 81.15 – deep into overbought territory. This extreme reading suggests the rally may be overextended and due for a pullback. Trading volume remains robust at $48.6 million, supporting the current price action but also indicating potential volatility ahead. Given the technical setup, traders should consider taking partial profits on long positions while maintaining stop-losses around the $17.00 support level. New entries at current levels carry elevated risk due to the overbought conditions. Watch for a potential consolidation phase between $17.20-$18.00 before the next significant move.

Key Metrics

| Price | 17.6000 USDT |

| 24h Change | 1.85% |

| 24h Volume | 48589871.79 |

| RSI(14) | 81.15 |

| SMA20 / SMA50 | 17.16 / 17.31 |

| Daily Volatility | 4.46% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).