Sentiment: Bearish

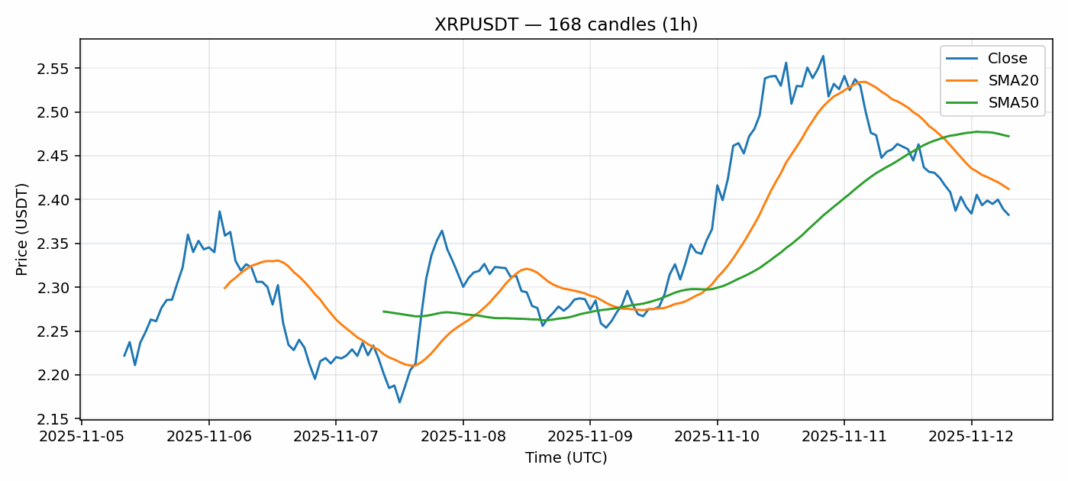

XRP is showing signs of capitulation as it trades at $2.38, down 3.85% over 24 hours amid elevated selling pressure. The RSI reading of 33 indicates the asset is approaching oversold territory, potentially setting up for a technical bounce. However, with price trading below both the 20-day SMA ($2.41) and 50-day SMA ($2.47), the near-term trend remains bearish. The $2.35-$2.40 zone represents critical support that must hold to prevent further declines toward $2.25. Volume remains substantial at $256 million, suggesting institutional interest despite the price weakness. Traders should consider scaling into long positions near current levels with tight stops below $2.35, while aggressive sellers might wait for any bounce toward $2.45-$2.50 to add short exposure. The high volatility reading of 3.6% suggests continued sharp moves are likely, so position sizing should be conservative.

Key Metrics

| Price | 2.3826 USDT |

| 24h Change | -3.85% |

| 24h Volume | 256187025.44 |

| RSI(14) | 33.24 |

| SMA20 / SMA50 | 2.41 / 2.47 |

| Daily Volatility | 3.60% |

Ripple — 1h candles, 7D window (SMA20/SMA50, RSI).