Sentiment: Bearish

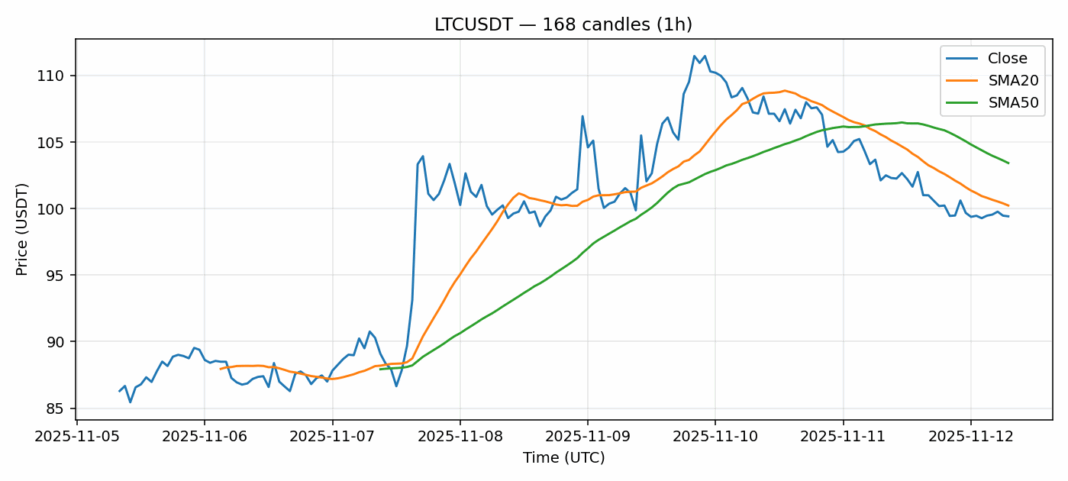

LTCUSDT is showing signs of potential capitulation as price hovers near $99.42, down 4.14% over 24 hours. The RSI reading of 37.58 indicates oversold conditions, though it hasn’t yet reached extreme levels below 30. Trading below both the 20-day SMA ($100.23) and 50-day SMA ($103.43) confirms the bearish momentum remains intact. However, the elevated volatility at nearly 7% suggests we could see sharp reversals. Volume remains substantial at over $80 million, indicating continued institutional interest despite the price decline. For traders, consider scaling into long positions between $95-98 with tight stops below $94. The oversold RSI combined with strong historical support around $95 makes this an attractive risk-reward entry zone. Short-term traders might wait for a break above the 20-day SMA to confirm momentum shift before entering.

Key Metrics

| Price | 99.4200 USDT |

| 24h Change | -4.14% |

| 24h Volume | 80101724.98 |

| RSI(14) | 37.58 |

| SMA20 / SMA50 | 100.23 / 103.43 |

| Daily Volatility | 6.99% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).