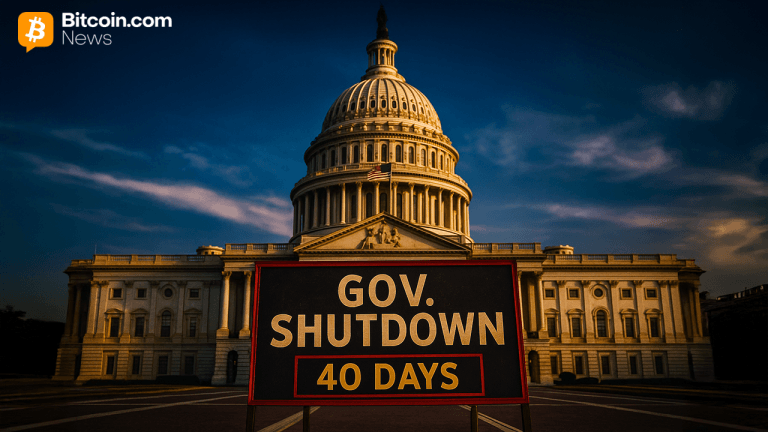

The United States government shutdown has reached its 40th day, marking one of the longest federal funding gaps in the nation’s history. Prediction markets, including Polymarket and Kalshi, are reflecting growing skepticism about a swift resolution, with traders placing significant odds on the stalemate persisting until at least mid-November. Market data indicates approximately 60% of participants anticipate the deadlock will extend beyond that timeframe, underscoring deepening concerns over political gridlock in Washington.

This prolonged shutdown has surpassed previous records, creating widespread uncertainty across federal agencies and public services. Analysts note that the extended duration is influencing market sentiment, as traders leverage prediction platforms to hedge against ongoing political instability. The evolving bets highlight how decentralized forecasting tools are increasingly being used to gauge real-time public expectations on critical governmental events.

While congressional negotiations continue behind closed doors, the absence of a clear path to resolution has amplified economic and operational challenges. Federal employees face continued furloughs, and key services remain disrupted, compounding the shutdown’s societal impact. As market participants monitor legislative developments, the high probability of an extended impasse suggests confidence in a near-term breakthrough remains low among informed observers.