Sentiment: Neutral

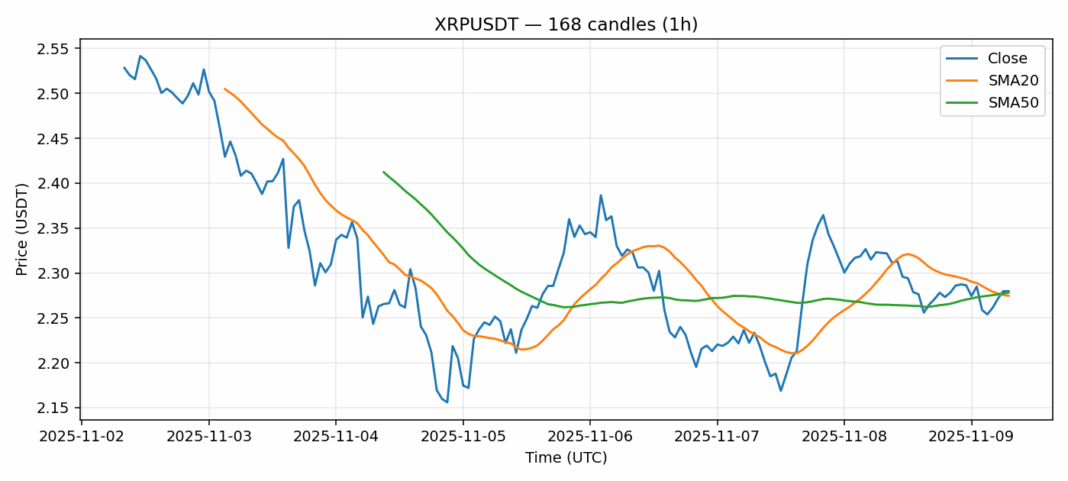

XRP is showing consolidation patterns after a slight 1.9% pullback, currently trading at $2.28 with moderate volatility around 4.56%. The RSI reading of 54 suggests neutral momentum, neither overbought nor oversold, indicating balanced market participation. Notably, price action is hovering near both the 20-day SMA ($2.27) and 50-day SMA ($2.28), creating a critical technical juncture. Volume remains substantial at $148 million, suggesting institutional interest persists despite the minor correction. For traders, watch for a decisive break above $2.30 for bullish continuation toward $2.40 resistance. Alternatively, a breakdown below $2.25 could trigger further selling toward $2.15 support. Position sizing should remain conservative given the elevated volatility environment. Consider dollar-cost averaging on dips for longer-term holdings while active traders might employ range-bound strategies between key technical levels.

Key Metrics

| Price | 2.2798 USDT |

| 24h Change | -1.92% |

| 24h Volume | 148643171.12 |

| RSI(14) | 54.22 |

| SMA20 / SMA50 | 2.27 / 2.28 |

| Daily Volatility | 4.56% |

Ripple — 1h candles, 7D window (SMA20/SMA50, RSI).