Sentiment: Neutral

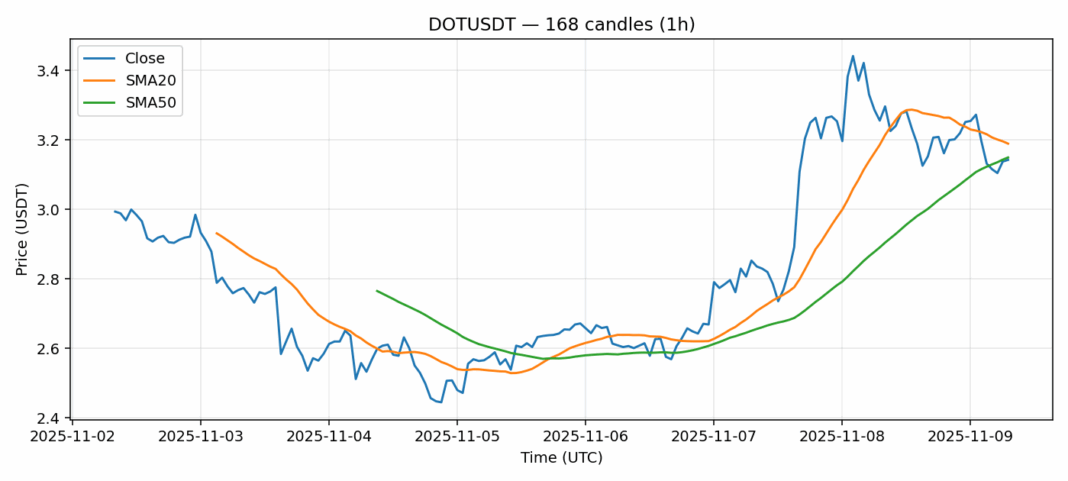

DOT is showing signs of consolidation after a 4.4% pullback, currently trading at $3.143 with elevated volatility near 7.7%. The RSI reading of 41 suggests we’re approaching oversold territory, though not yet at extreme levels. Notably, price has dipped below the 20-day SMA at $3.19 while hovering near the 50-day SMA at $3.15, indicating potential support at these technical levels. The $490M daily volume shows decent participation despite the downward move. For traders, this presents a potential accumulation zone between $3.10-$3.15, with a break below $3.10 likely triggering further downside toward $3.00. Resistance sits firmly at the $3.20-$3.25 zone where the 20-day SMA converges with recent swing highs. Position sizing should remain conservative given the heightened volatility environment. Consider scaling into long positions on weakness with tight stops, targeting a return to the $3.30 resistance area.

Key Metrics

| Price | 3.1430 USDT |

| 24h Change | -4.44% |

| 24h Volume | 49006990.78 |

| RSI(14) | 41.26 |

| SMA20 / SMA50 | 3.19 / 3.15 |

| Daily Volatility | 7.66% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).