Sentiment: Neutral

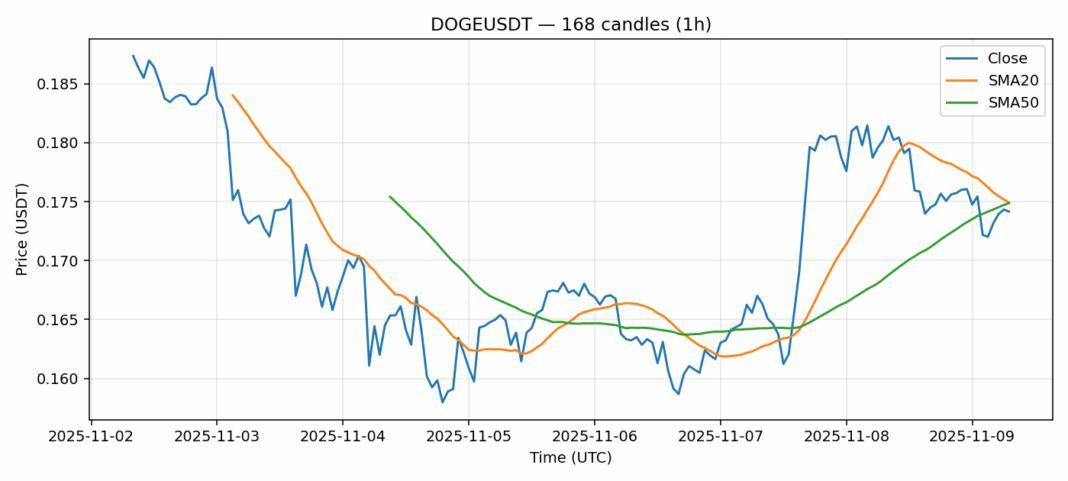

DOGE is showing consolidation patterns after a 3% pullback over the past 24 hours, currently trading at $0.17416. The cryptocurrency finds itself at a critical technical juncture, with price hovering near both the 20-day SMA ($0.174932) and 50-day SMA ($0.1748724), indicating potential for a significant directional move. The RSI reading of 47 suggests neither overbought nor oversold conditions, providing room for movement in either direction. Trading volume remains substantial at $153 million, though the elevated 5.46% volatility indicates continued market uncertainty. For traders, the current setup suggests waiting for a clear breakout above $0.176 or breakdown below $0.172 before establishing positions. The convergence of moving averages creates a technical compression that typically precedes substantial moves. Risk management remains crucial given DOGE’s historical volatility patterns and current market indecision.

Key Metrics

| Price | 0.1742 USDT |

| 24h Change | -3.03% |

| 24h Volume | 153208086.83 |

| RSI(14) | 47.07 |

| SMA20 / SMA50 | 0.17 / 0.17 |

| Daily Volatility | 5.46% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).