Sentiment: Neutral

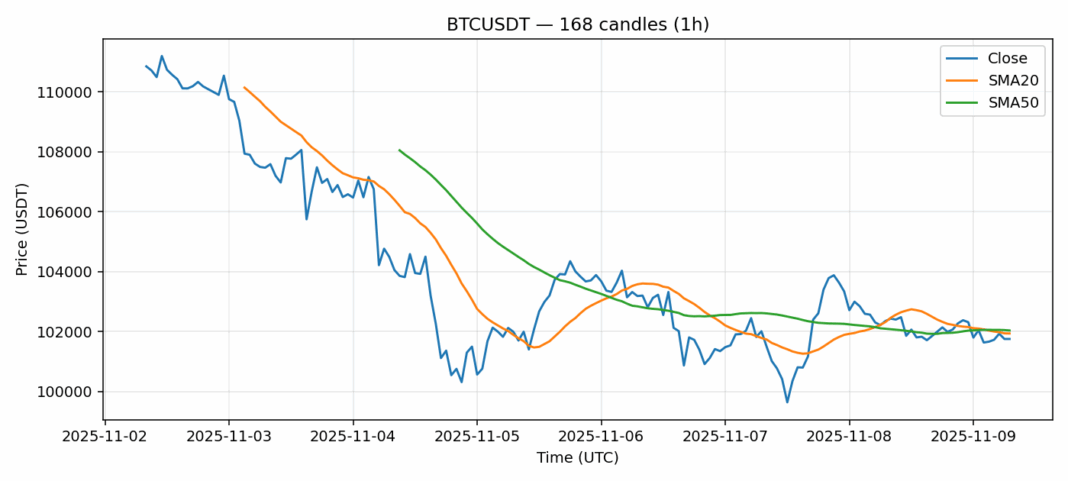

Bitcoin is currently trading at $101,752 after a modest 0.47% decline over the past 24 hours. The cryptocurrency finds itself in a critical technical position, trading just below both the 20-day SMA ($101,936) and 50-day SMA ($102,036), suggesting near-term resistance overhead. The RSI reading of 44.95 indicates neither overbought nor oversold conditions, providing room for movement in either direction. Trading volume remains robust at $1.17 billion, signaling continued institutional interest despite the slight pullback. Volatility has moderated to 2.46%, reflecting relative stability at current levels. For traders, the key levels to watch are the SMA convergence around $102,000 as resistance and the $101,500 level as immediate support. A decisive break above the moving average cluster could trigger momentum buying toward $103,000, while failure to hold current support might test the $101,000 psychological level. Position sizing should remain conservative until clearer directional momentum emerges.

Key Metrics

| Price | 101752.8300 USDT |

| 24h Change | -0.47% |

| 24h Volume | 1166238021.81 |

| RSI(14) | 44.95 |

| SMA20 / SMA50 | 101935.54 / 102035.66 |

| Daily Volatility | 2.46% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).