Sentiment: Bullish

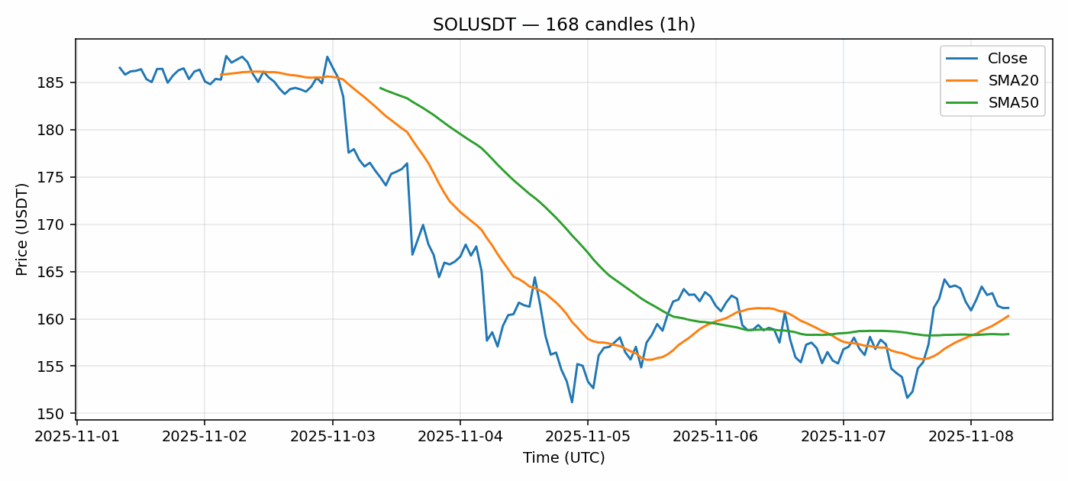

SOL is showing resilience at the $161 level, trading marginally above both its 20-day ($160.30) and 50-day ($158.38) SMAs, indicating underlying strength. The 2.67% 24-hour gain on substantial $666M volume suggests institutional accumulation despite choppy market conditions. With RSI hovering near 50, SOL sits in neutral territory with room for momentum in either direction. The 5% volatility reading reflects typical altcoin behavior but remains manageable for position traders. Current price action suggests consolidation before the next major move. Traders should watch for a decisive break above $165 with volume confirmation for bullish continuation, while a breakdown below $155 could trigger profit-taking toward $150 support. Consider scaling into positions during dips toward the SMA cluster, using tight stops given the elevated volatility environment. Options traders might explore defined-risk strategies to capitalize on expected volatility expansion.

Key Metrics

| Price | 161.1500 USDT |

| 24h Change | 2.67% |

| 24h Volume | 665796502.04 |

| RSI(14) | 49.96 |

| SMA20 / SMA50 | 160.30 / 158.38 |

| Daily Volatility | 5.02% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).