Sentiment: Bullish

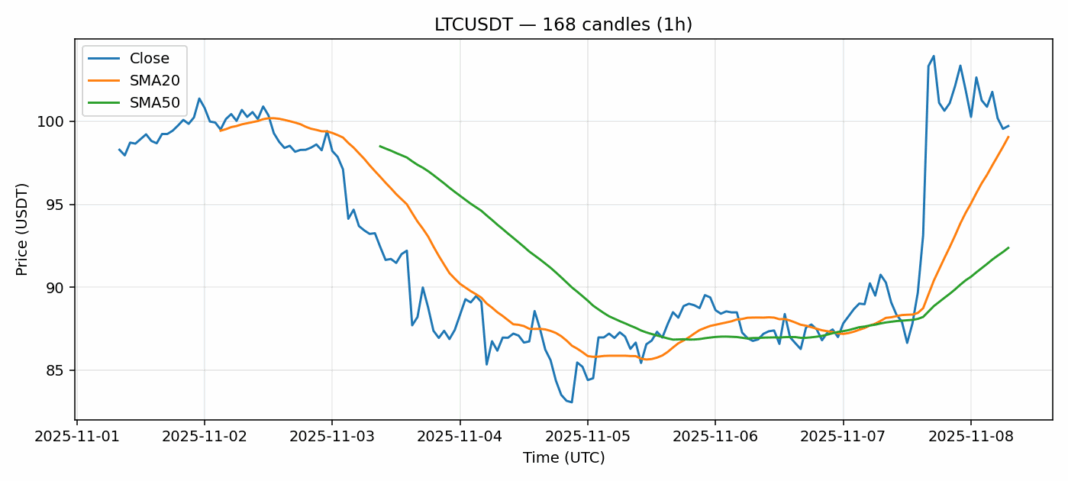

Litecoin is showing intriguing technical signals as it trades at $99.71, posting a substantial 11.3% gain over the past 24 hours. The current price sits just above the 20-day SMA at $99.05 while maintaining a healthy distance above the 50-day SMA at $92.38, suggesting underlying strength. The RSI reading of 37 indicates the asset remains in oversold territory despite the recent rally, leaving ample room for further upside. Trading volume of $186 million demonstrates solid institutional interest at these levels. The 6.6% volatility metric suggests LTC is experiencing typical market swings without excessive price action. For traders, this setup presents a compelling opportunity to accumulate on any dips toward the $95-97 support zone. The breach above the 20-day SMA with conviction could trigger a move toward $105 resistance. Position sizing should remain conservative given the broader market uncertainty, but the technical foundation appears solid for continued recovery.

Key Metrics

| Price | 99.7100 USDT |

| 24h Change | 11.30% |

| 24h Volume | 186450315.33 |

| RSI(14) | 37.26 |

| SMA20 / SMA50 | 99.05 / 92.38 |

| Daily Volatility | 6.64% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).