Sentiment: Neutral

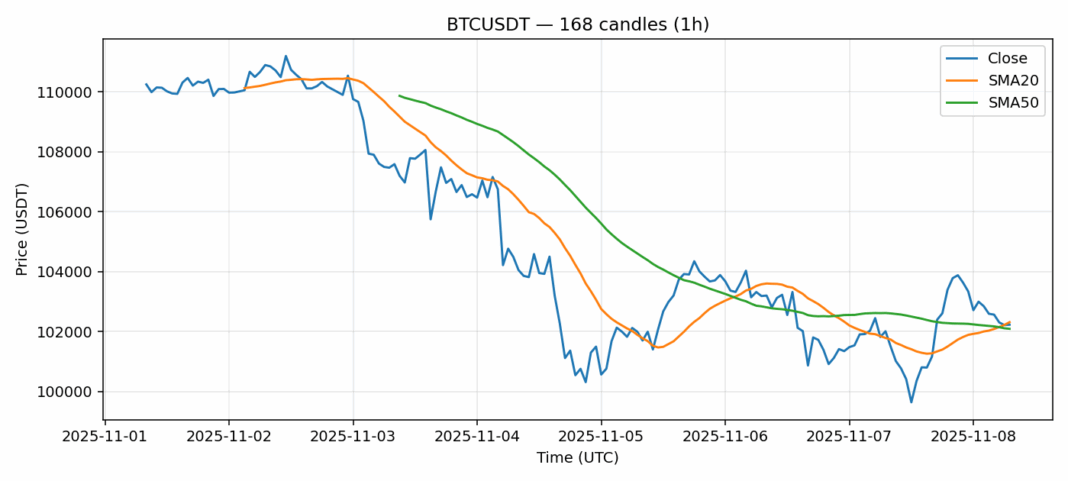

Bitcoin continues to consolidate around the $102,000 level, showing remarkable stability despite the psychological significance of this price point. The current RSI reading of 47.73 indicates neither overbought nor oversold conditions, suggesting balanced market momentum. Trading volume remains robust at over $3 billion, providing solid liquidity for institutional and retail participants alike. The proximity between the 20-day SMA ($102,312) and 50-day SMA ($102,090) reveals a tightly compressed trading range, with Bitcoin currently trading between these key moving averages. The modest 0.4% gain over 24 hours combined with relatively low volatility of 2.46% points to cautious accumulation rather than speculative frenzy. For traders, this represents an ideal range-trading environment. Consider establishing positions near the 50-day SMA support with tight stops, while monitoring for a decisive break above the 20-day SMA for potential momentum continuation. The current setup favors patient accumulation over aggressive positioning.

Key Metrics

| Price | 102228.3100 USDT |

| 24h Change | 0.40% |

| 24h Volume | 3057154623.41 |

| RSI(14) | 47.73 |

| SMA20 / SMA50 | 102312.87 / 102090.89 |

| Daily Volatility | 2.46% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).