Sentiment: Neutral

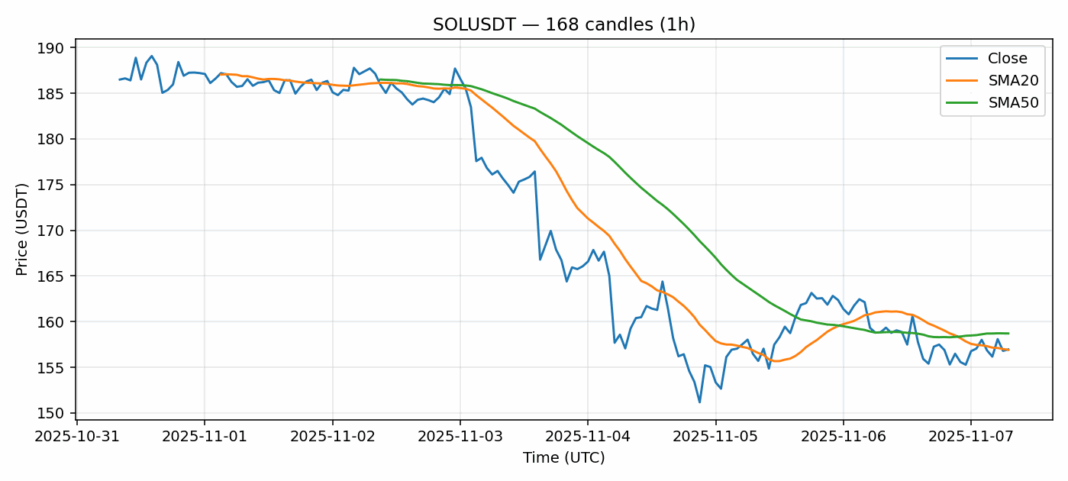

SOL is currently trading at $156.96, showing slight consolidation after recent volatility. The -1.25% 24-hour decline suggests minor profit-taking, though trading volume remains robust at $540 million, indicating sustained institutional interest. Technical indicators present a mixed picture: RSI at 48.82 sits in neutral territory, neither overbought nor oversold, while price action hovers near both the 20-day SMA ($156.91) and 50-day SMA ($158.71). This convergence around key moving averages typically precedes significant directional moves. Current volatility of 4.86% reflects typical SOL market conditions. Traders should watch for a decisive break above $160 for bullish confirmation or a drop below $154 for bearish momentum. Given the tight range, consider accumulating on dips toward $152 support with stops below $148. The overall structure suggests accumulation before the next leg higher, but patience is warranted until clearer directional signals emerge.

Key Metrics

| Price | 156.9600 USDT |

| 24h Change | -1.25% |

| 24h Volume | 539993348.11 |

| RSI(14) | 48.82 |

| SMA20 / SMA50 | 156.91 / 158.71 |

| Daily Volatility | 4.86% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).