Sentiment: Bearish

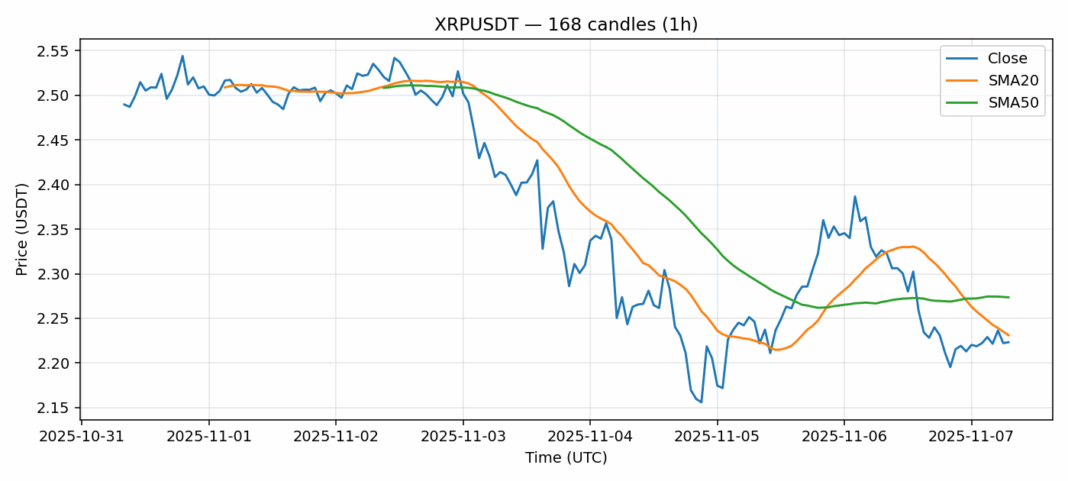

XRP is showing concerning technical weakness as it trades at $2.22, below both its 20-day SMA ($2.23) and 50-day SMA ($2.27). The 4.25% decline over the past 24 hours comes despite substantial trading volume of $355 million, suggesting genuine selling pressure rather than temporary volatility. The RSI reading of 43.6 indicates neither oversold nor overbought conditions, leaving room for further downside. Current price action suggests XRP is struggling to maintain support above key moving averages, which could signal a shift in medium-term momentum. Traders should watch for a break below $2.20, which could trigger additional selling toward the $2.10-$2.15 support zone. Until XRP reclaims the $2.30 level with conviction, risk remains skewed to the downside. Consider reducing long exposure and implementing tighter stop-losses around $2.18. The high volatility reading of 4.33% suggests traders should position size accordingly and avoid overleveraging in current conditions.

Key Metrics

| Price | 2.2233 USDT |

| 24h Change | -4.25% |

| 24h Volume | 354960696.17 |

| RSI(14) | 43.63 |

| SMA20 / SMA50 | 2.23 / 2.27 |

| Daily Volatility | 4.33% |

Ripple — 1h candles, 7D window (SMA20/SMA50, RSI).