Sentiment: Bullish

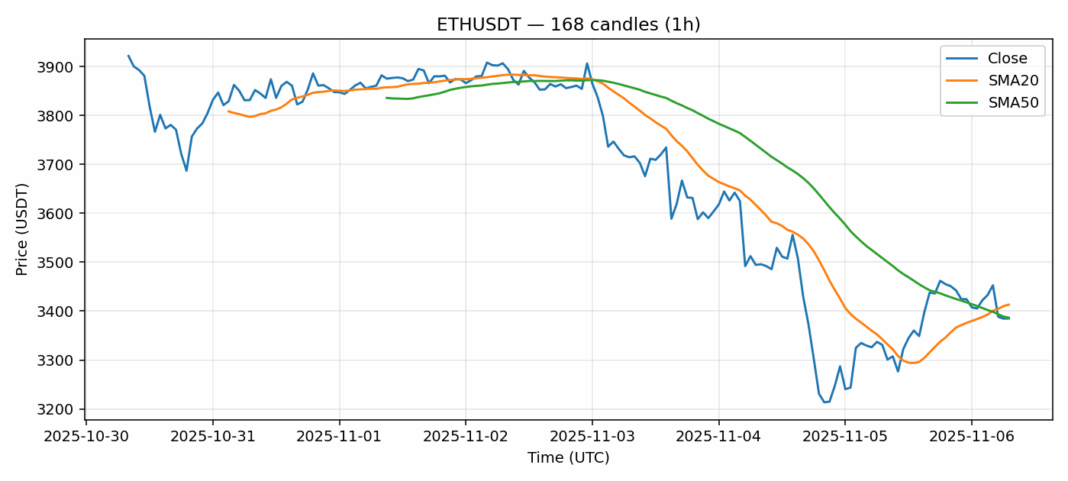

Ethereum is showing intriguing technical positioning at the $3,385 level, with the current price trading just below the 20-day SMA at $3,413 but holding above the critical 50-day SMA at $3,387. The RSI reading of 37 suggests ETH is approaching oversold territory, potentially setting up for a near-term bounce. Despite the modest 1.4% gain over the past 24 hours, the substantial $2.1 billion trading volume indicates strong institutional interest at these levels. The 4.1% volatility reading suggests relatively stable price action compared to recent sessions. Traders should watch for a decisive break above the 20-day SMA, which could trigger momentum toward the $3,500 resistance zone. Current positioning favors accumulation on any dips toward $3,350, with tight stops below the 50-day SMA. The convergence of moving averages suggests we’re approaching a significant directional move – likely upward given the oversold RSI conditions.

Key Metrics

| Price | 3384.9400 USDT |

| 24h Change | 1.40% |

| 24h Volume | 2085796196.36 |

| RSI(14) | 37.13 |

| SMA20 / SMA50 | 3413.25 / 3386.65 |

| Daily Volatility | 4.12% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).