Sentiment: Neutral

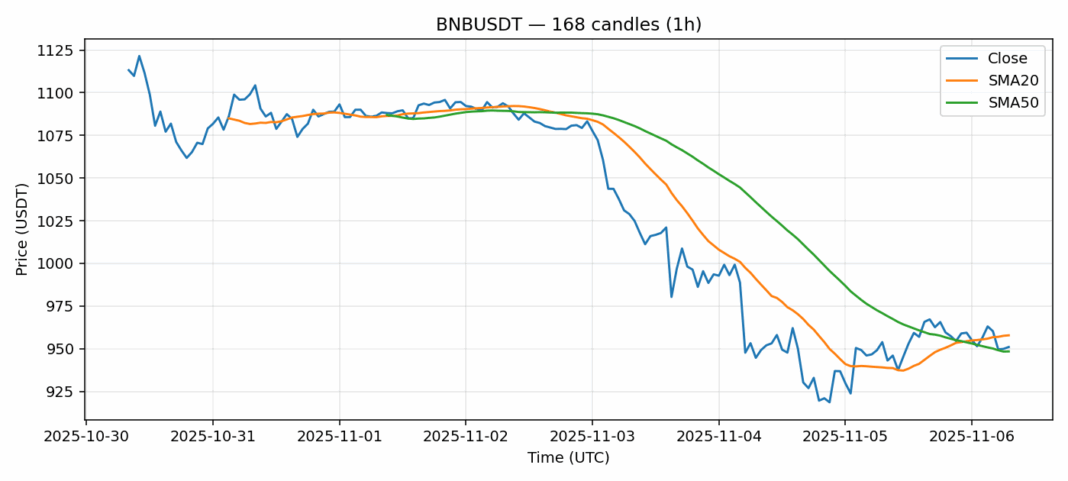

BNB is showing intriguing technical positioning at $950.95, trading just above its critical 50-day SMA support at $948.36 while remaining below the 20-day SMA resistance at $957.80. The 0.37% gain over 24 hours suggests consolidation after recent volatility, with the RSI reading of 39.14 indicating oversold conditions that could signal a potential rebound. Trading volume of $350 million demonstrates healthy market participation. The current setup presents a classic technical dilemma – while price action appears weak, the oversold RSI combined with holding above the 50-SMA suggests underlying strength. Traders should watch for a decisive break above $958 for bullish confirmation, targeting $970-$975 resistance zones. A breakdown below $945 could trigger further selling toward $930 support. Given the oversold momentum readings, risk-reward favors cautious long positions with tight stops below $945.

Key Metrics

| Price | 950.9500 USDT |

| 24h Change | 0.37% |

| 24h Volume | 350454677.92 |

| RSI(14) | 39.14 |

| SMA20 / SMA50 | 957.80 / 948.36 |

| Daily Volatility | 3.93% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).