Sentiment: Bearish

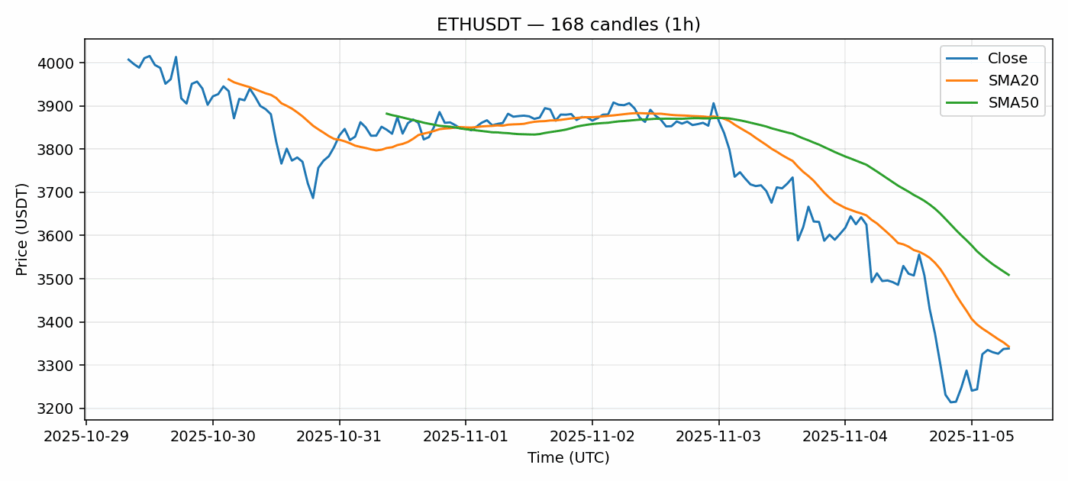

Ethereum faces significant headwinds as ETHUSDT trades at $3,338, down nearly 5% over the past 24 hours. The current price sits just below the 20-day SMA at $3,343, indicating weakening short-term momentum, while the substantial gap below the 50-day SMA at $3,509 suggests persistent medium-term pressure. The RSI reading of 45.55 shows ETH is approaching oversold territory but hasn’t reached extreme levels yet. Trading volume remains robust at over $5.2 billion, confirming active participation in this downturn. The 4.17% volatility reading indicates elevated price swings, typical during corrective phases. For traders, current levels might present accumulation opportunities for those with longer time horizons, but strict risk management is essential. Consider waiting for RSI to dip below 40 for better entry points, with key support around $3,250-$3,280. Resistance sits firmly at the 20-day SMA, which ETH must reclaim to signal any meaningful recovery.

Key Metrics

| Price | 3338.1800 USDT |

| 24h Change | -4.97% |

| 24h Volume | 5284067416.42 |

| RSI(14) | 45.55 |

| SMA20 / SMA50 | 3342.85 / 3508.86 |

| Daily Volatility | 4.17% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).