Sentiment: Bearish

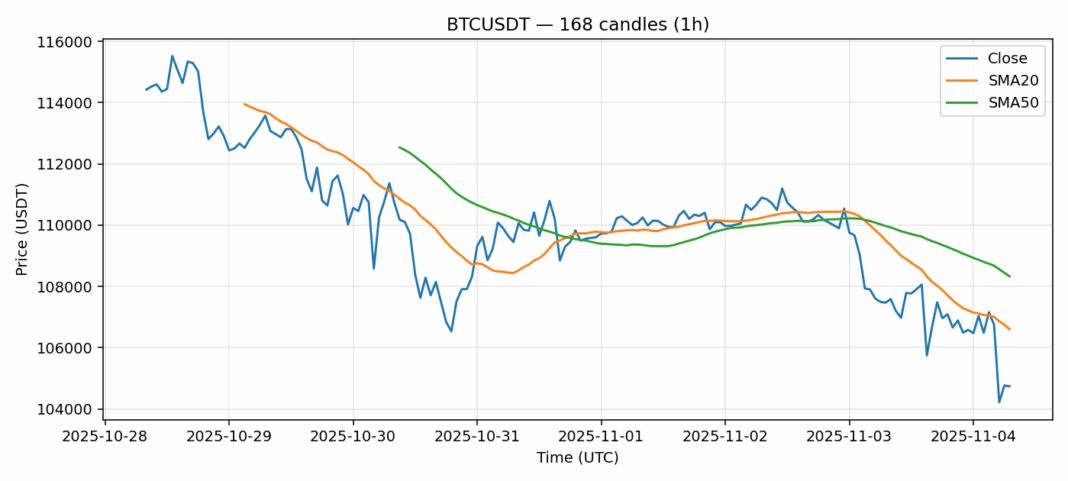

Bitcoin faces a critical technical juncture as it trades at $104,740, down 2.55% over 24 hours. The current price sits below both the 20-day SMA ($106,597) and 50-day SMA ($108,327), indicating persistent bearish pressure in the near to medium term. However, the RSI reading of 31 suggests BTC is approaching oversold territory, potentially setting up for a relief rally. Trading volume remains substantial at $3.43 billion, showing continued institutional interest despite the price decline. The 2.58% volatility indicates relatively stable conditions for a crypto asset. Traders should watch for a decisive break above the 20-day SMA as a potential bullish signal, while a failure to hold current support could see a test of the $100,000 psychological level. Position sizing should remain conservative until clearer directional momentum emerges. Consider dollar-cost averaging for long-term holders, while short-term traders might wait for RSI to recover above 35 before entering new long positions.

Key Metrics

| Price | 104739.6000 USDT |

| 24h Change | -2.55% |

| 24h Volume | 3431069654.17 |

| RSI(14) | 31.06 |

| SMA20 / SMA50 | 106596.91 / 108326.84 |

| Daily Volatility | 2.58% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).