Sentiment: Bearish

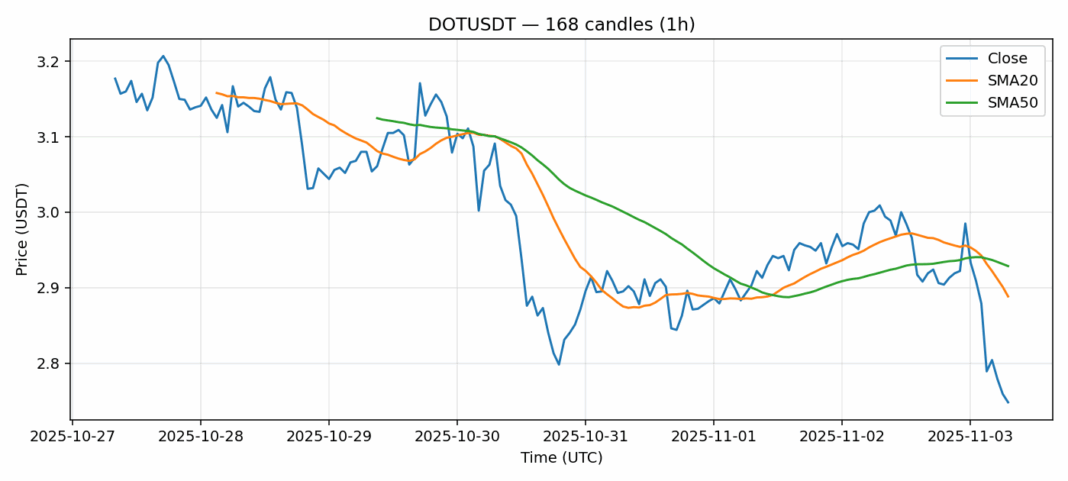

DOT is showing significant weakness against USDT, currently trading at $2.748 with a concerning 8.37% decline over the past 24 hours. The technical picture reveals deeply oversold conditions with RSI plunging to 26.09, well below the traditional 30 oversold threshold. Price action has broken below both the 20-day SMA ($2.888) and 50-day SMA ($2.929), indicating sustained bearish momentum. While the elevated 4.15% volatility suggests nervous market sentiment, the extreme RSI reading often precedes potential relief rallies. Volume remains substantial at $19.5 million, confirming active participation in the sell-off. For traders, this presents a classic contrarian opportunity – consider scaling into long positions with tight stops below $2.70, targeting a rebound toward the $2.85-2.90 resistance zone. However, given the broken moving averages, any recovery attempts should be treated cautiously until DOT reclaims the $2.90 level convincingly.

Key Metrics

| Price | 2.7480 USDT |

| 24h Change | -8.37% |

| 24h Volume | 19535028.65 |

| RSI(14) | 26.09 |

| SMA20 / SMA50 | 2.89 / 2.93 |

| Daily Volatility | 4.15% |

Polkadot — 1h candles, 7D window (SMA20/SMA50, RSI).