Sentiment: Neutral

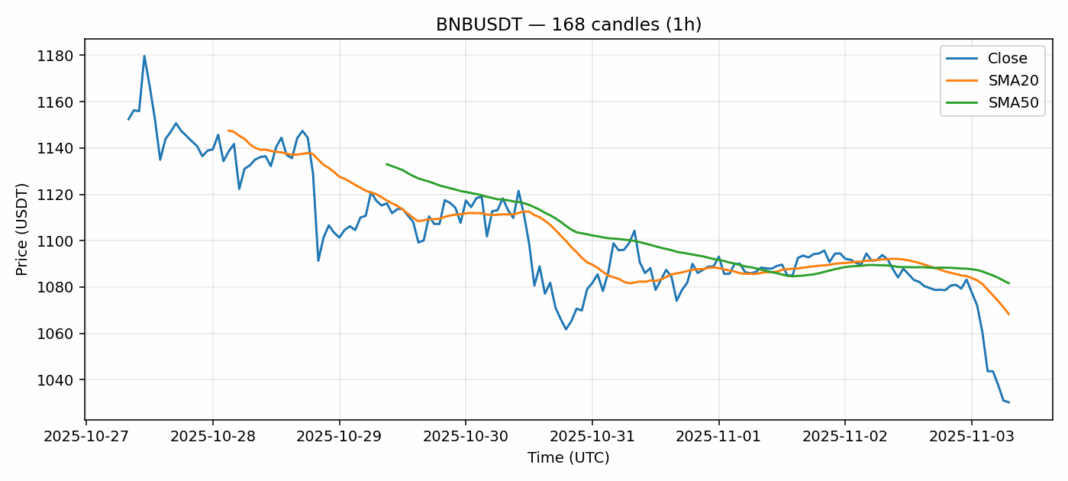

BNB is showing concerning technical signals as it trades at $1,030, down 5.6% over the past 24 hours. The most alarming indicator is the RSI reading of 10.34, which represents extreme oversold conditions rarely seen in major cryptocurrencies. While BNB trades below both its 20-day SMA ($1,068) and 50-day SMA ($1,081), the severe oversold RSI suggests a potential relief rally could be imminent. Trading volume remains substantial at $292 million, indicating continued market participation despite the downturn. The current volatility of 3.1% provides some trading opportunities for nimble investors. For traders, consider scaling into long positions cautiously given the extreme oversold reading, but maintain tight stop-losses below $1,000. Short-term traders might look for bounce opportunities toward the $1,060-$1,070 resistance zone, while longer-term investors should wait for confirmation of a bottom formation before committing significant capital.

Key Metrics

| Price | 1030.2500 USDT |

| 24h Change | -5.62% |

| 24h Volume | 291865453.30 |

| RSI(14) | 10.34 |

| SMA20 / SMA50 | 1068.40 / 1081.68 |

| Daily Volatility | 3.11% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).