Sentiment: Bearish

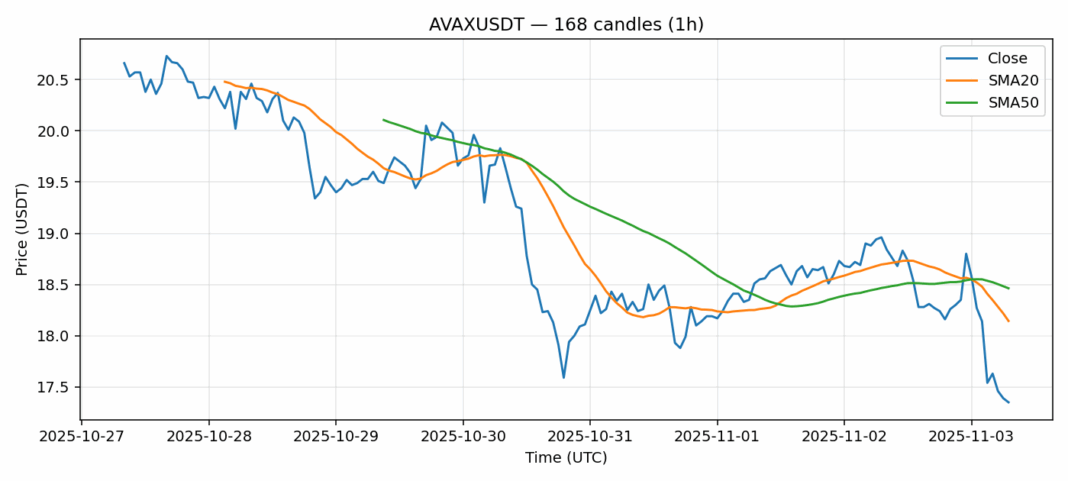

AVAX is showing significant weakness today, down 8.25% to $17.35 as selling pressure intensifies across the crypto market. The current RSI reading of 30.67 indicates the asset is approaching oversold territory, which historically presents potential buying opportunities for contrarian traders. However, with price trading below both the 20-day SMA ($18.14) and 50-day SMA ($18.46), the technical structure remains bearish in the short term. Volume has surged to over $41 million, suggesting capitulation may be underway. For traders, consider scaling into long positions between $16.50-$17.00 with tight stops below $16.20. The elevated volatility of 4.2% means position sizing should be conservative. Resistance sits at $18.50, while a break below $16 could trigger further declines toward $15 support. Wait for RSI divergence or volume confirmation before committing larger capital.

Key Metrics

| Price | 17.3500 USDT |

| 24h Change | -8.25% |

| 24h Volume | 41406884.54 |

| RSI(14) | 30.67 |

| SMA20 / SMA50 | 18.14 / 18.46 |

| Daily Volatility | 4.20% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).