Sentiment: Bullish

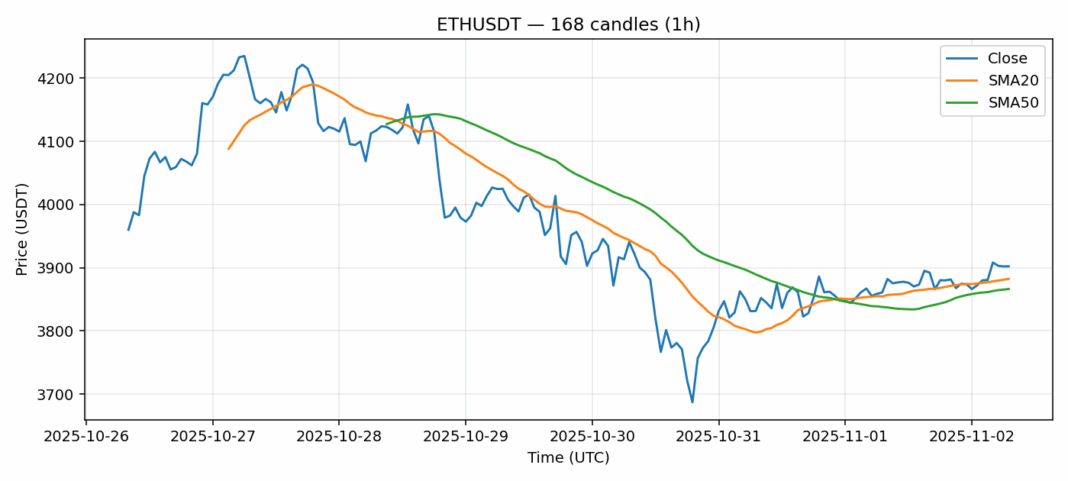

Ethereum continues to show resilience above the $3,900 level, posting a modest 1.12% gain over the past 24 hours. The current price sits comfortably above both the 20-day SMA ($3,882) and 50-day SMA ($3,866), indicating underlying strength in the medium-term trend. However, traders should note the RSI reading of 69.36 suggests ETH is approaching overbought territory, which could signal potential near-term consolidation. The substantial $596 million trading volume demonstrates healthy market participation, while the 3.15% volatility indicates relatively stable price action compared to typical crypto standards. For traders, consider taking partial profits near the $3,950-$4,000 resistance zone while maintaining core positions. Support appears firm around $3,850, with a break below potentially testing the $3,800 level. Position sizing remains crucial given the elevated RSI reading.

Key Metrics

| Price | 3902.2400 USDT |

| 24h Change | 1.12% |

| 24h Volume | 596134065.87 |

| RSI(14) | 69.36 |

| SMA20 / SMA50 | 3882.29 / 3866.36 |

| Daily Volatility | 3.15% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).