Sentiment: Bullish

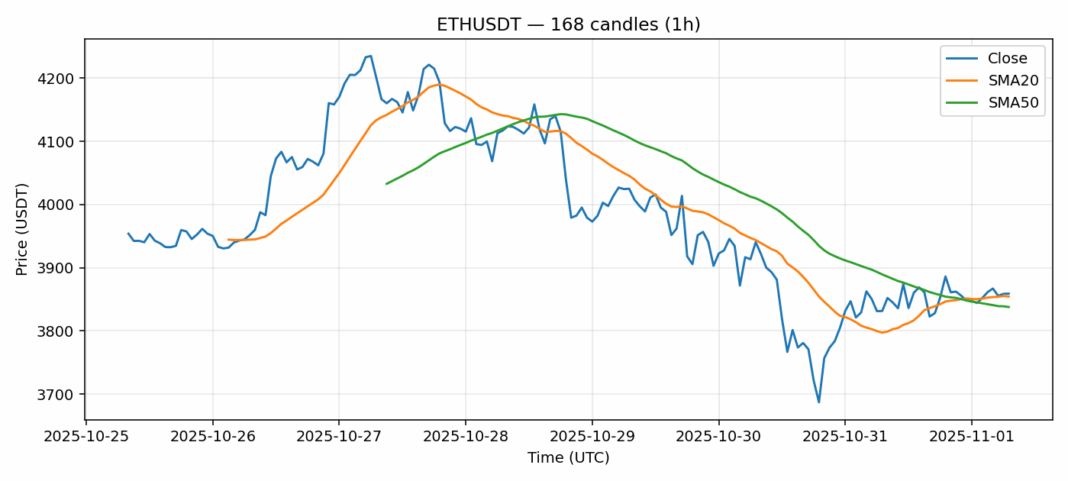

Ethereum continues to show impressive resilience, trading at $3,859 with a modest 0.73% gain over the past 24 hours. The current technical picture reveals ETH is trading above both its 20-day SMA ($3,854) and 50-day SMA ($3,838), indicating underlying bullish momentum. The RSI reading of 61 suggests the asset is approaching overbought territory but still has room for further upside before reaching extreme levels. Trading volume remains robust at $1.6 billion, supporting the current price action. The 3.14% volatility reading indicates relatively stable conditions compared to typical crypto market swings. For traders, the key resistance to watch is the $3,900-$3,950 zone, where we might see profit-taking pressure. Support holds firm around $3,800-$3,820, coinciding with the moving average cluster. Consider scaling into positions on any dips toward support while maintaining tight stop-losses below $3,780. The overall structure favors continuation toward higher targets if volume persists.

Key Metrics

| Price | 3858.9900 USDT |

| 24h Change | 0.73% |

| 24h Volume | 1609679447.94 |

| RSI(14) | 61.00 |

| SMA20 / SMA50 | 3854.44 / 3837.80 |

| Daily Volatility | 3.14% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).