The Bitcoin mining sector is undergoing a fundamental transformation following the April 2024 halving event, which reduced block rewards from 6.25 to 3.125 BTC. This significant reduction in mining rewards has compressed hash prices, compelling major mining operators to diversify their revenue streams beyond traditional cryptocurrency mining operations.

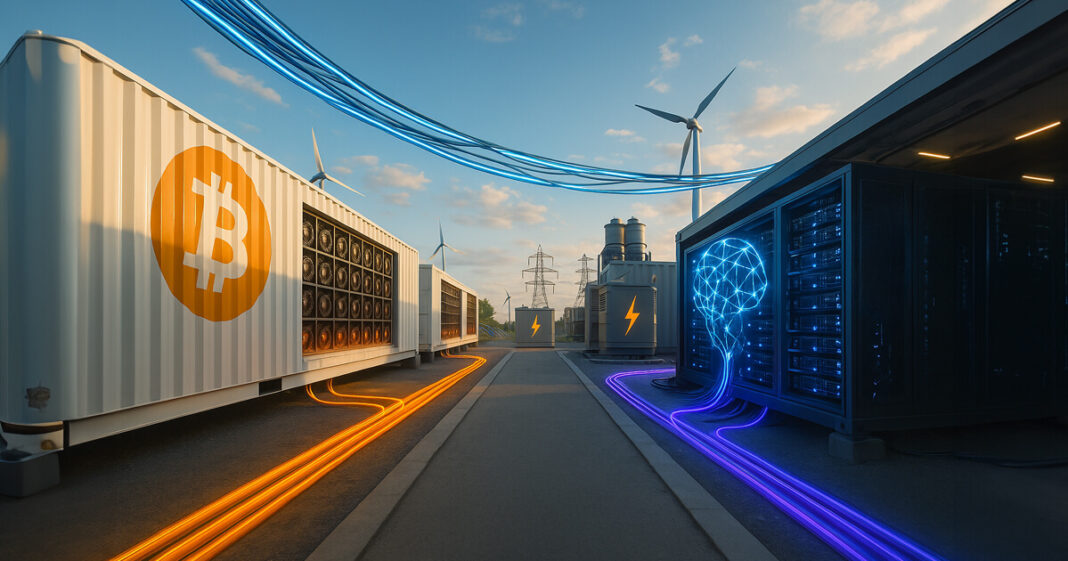

Industry leaders are increasingly repurposing their substantial computational infrastructure to serve emerging technology sectors requiring high-performance computing capabilities. Core Scientific has demonstrated this strategic shift by committing 500 megawatts of its infrastructure to CoreWeave, signaling a broader industry trend toward infrastructure repurposing.

This transition represents a pragmatic response to changing economic conditions within the cryptocurrency mining ecosystem. Rather than relying solely on potential fee market improvements to restore profitability margins, mining companies are actively leveraging their existing power contracts and data center infrastructure to capture new revenue opportunities.

The movement toward computational service diversification highlights the mining industry’s adaptability in the face of economic pressures. By monetizing their specialized infrastructure through alternative applications, Bitcoin miners are creating more sustainable business models while maintaining their core cryptocurrency operations. This strategic evolution demonstrates the industry’s maturation and its ability to navigate complex market dynamics while optimizing existing resources for broader technological applications.