Sentiment: Neutral

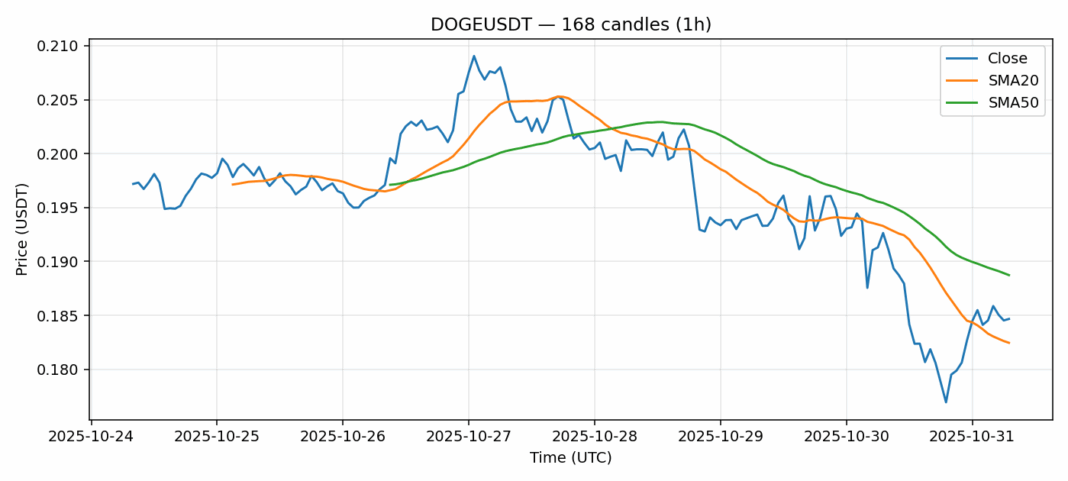

DOGE is showing mixed signals after a 3.48% pullback to $0.18467. While the 24-hour decline appears concerning, the meme coin continues trading above its 20-day SMA ($0.182) despite sitting below the 50-day SMA ($0.189), suggesting near-term support is holding. The RSI at 62 indicates slightly overbought conditions but leaves room for upward movement. Trading volume remains robust at $258M, demonstrating sustained market interest. Volatility at 3.48% presents both risk and opportunity for short-term traders. Current price action suggests DOGE is consolidating after recent gains, with key resistance around $0.19 and support near $0.182. Traders should watch for a decisive break above the 50-day SMA for bullish confirmation, while a drop below the 20-day SMA could signal further downside. Position sizing remains crucial given DOGE’s inherent volatility.

Key Metrics

| Price | 0.1847 USDT |

| 24h Change | -3.48% |

| 24h Volume | 258596578.12 |

| RSI(14) | 62.14 |

| SMA20 / SMA50 | 0.18 / 0.19 |

| Daily Volatility | 3.48% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).