Sentiment: Bullish

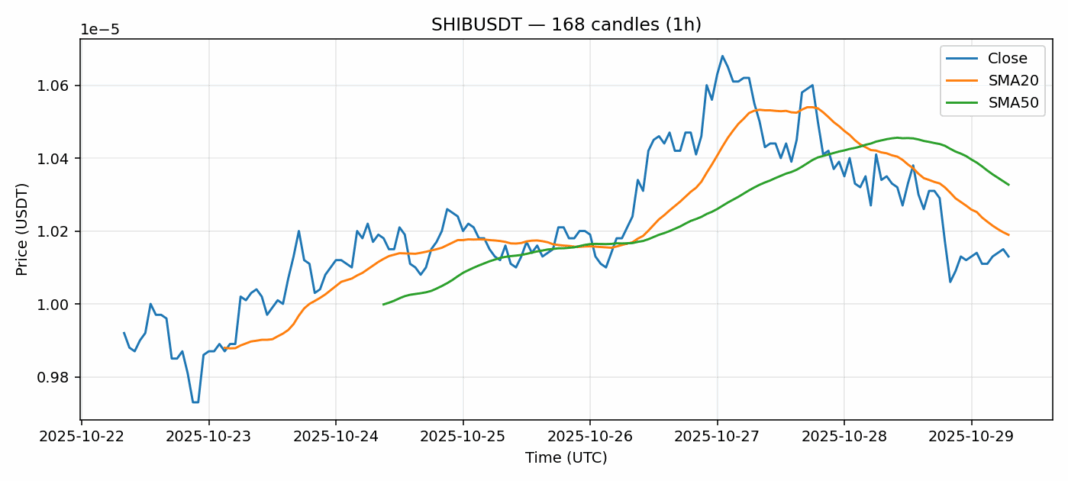

SHIB is showing signs of potential exhaustion in its current downtrend, trading at $0.00001013 with a 2.88% decline over the past 24 hours. The RSI reading of 29.54 indicates the meme token is deeply oversold, approaching levels that have historically preceded significant bounces. Trading volume remains substantial at $9.55 million, suggesting continued market interest despite the price weakness. SHIB currently trades below both its 20-day SMA ($0.00001019) and 50-day SMA ($0.00001033), confirming the bearish technical structure. However, the combination of oversold conditions and elevated volatility of 2.3% creates a potential setup for a relief rally. Traders might consider scaling into long positions with tight stops below recent lows, targeting a move back toward the 20-day SMA. Risk management remains crucial given meme token volatility.

Key Metrics

| Price | 0.0000 USDT |

| 24h Change | -2.88% |

| 24h Volume | 9554625.03 |

| RSI(14) | 29.54 |

| SMA20 / SMA50 | 0.00 / 0.00 |

| Daily Volatility | 2.30% |

Shiba Inu — 1h candles, 7D window (SMA20/SMA50, RSI).