Sentiment: Bullish

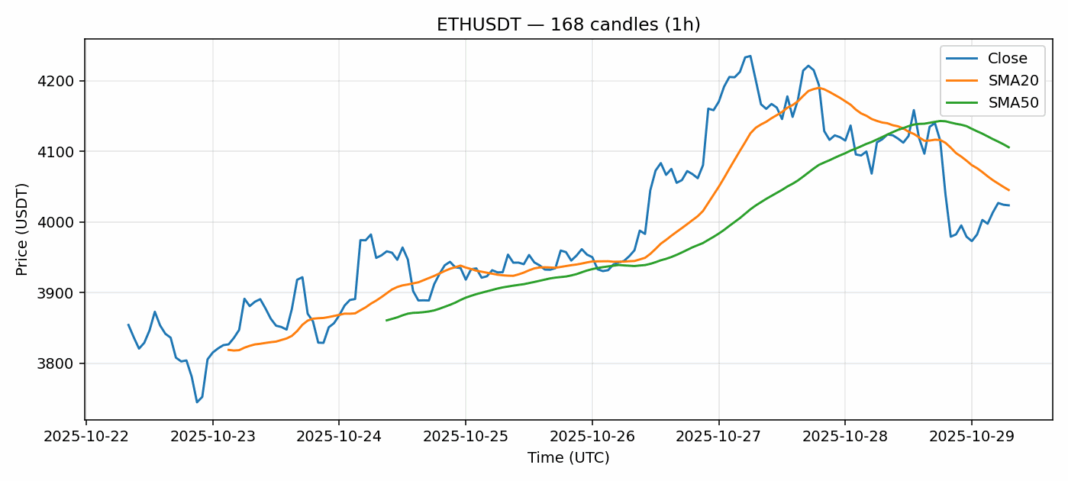

Ethereum is showing signs of oversold conditions as it trades at $4,023, down 2.18% over the past 24 hours. The RSI reading of 28 indicates extreme oversold territory, typically preceding a potential reversal. While ETH currently sits below both its 20-day SMA ($4,045) and 50-day SMA ($4,105), the proximity to these key moving averages suggests consolidation may be imminent. Trading volume remains robust at $1.78 billion, indicating continued institutional interest despite the recent pullback. The current volatility of 2.7% presents both risk and opportunity for traders. For position traders, this dip could represent an attractive entry point for long-term accumulation. Short-term traders should watch for a break above the 20-day SMA as confirmation of bullish momentum returning. Consider setting stop losses below $3,950 to manage downside risk while targeting resistance near $4,200 for profit-taking.

Key Metrics

| Price | 4023.7100 USDT |

| 24h Change | -2.18% |

| 24h Volume | 1786703462.07 |

| RSI(14) | 28.19 |

| SMA20 / SMA50 | 4045.37 / 4105.96 |

| Daily Volatility | 2.70% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).