Sentiment: Neutral

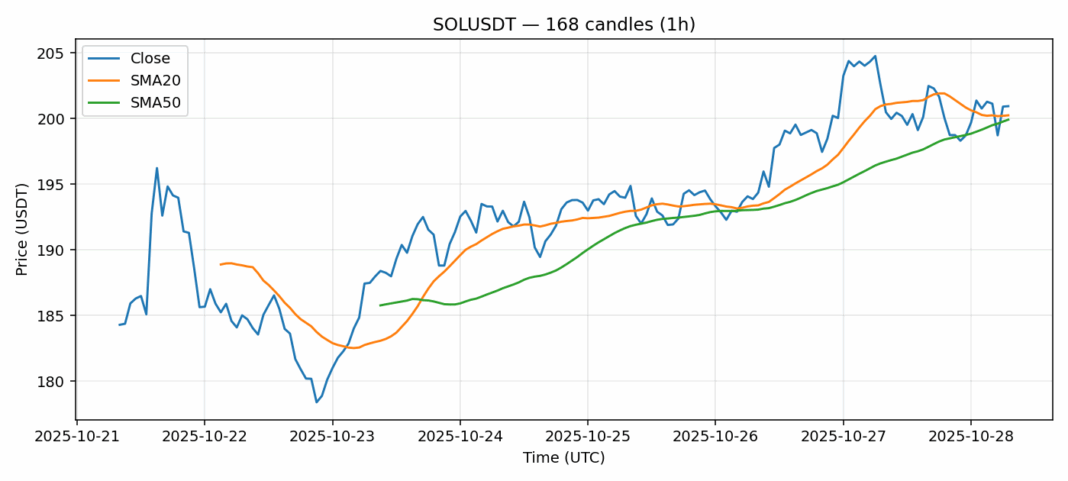

SOL is currently trading at $200.92, showing modest weakness with a 1.78% decline over the past 24 hours. The technical picture presents a mixed but potentially constructive setup. With the RSI at 44.79, SOL sits in neutral territory, neither overbought nor oversold, suggesting room for movement in either direction. The current price hovering just above both the 20-day SMA ($200.23) and 50-day SMA ($199.91) indicates potential support consolidation. Trading volume remains healthy at $625 million, providing adequate liquidity. The 3.32% volatility reading suggests moderate price swings are expected. For traders, the key level to watch is the $199-200 support zone where the moving averages converge. A sustained break below this level could trigger further selling toward $195, while holding above could spark a rebound toward $210 resistance. Consider scaling into positions with tight stops below $198 for risk management.

Key Metrics

| Price | 200.9200 USDT |

| 24h Change | -1.78% |

| 24h Volume | 625249548.11 |

| RSI(14) | 44.79 |

| SMA20 / SMA50 | 200.23 / 199.91 |

| Daily Volatility | 3.32% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).