Sentiment: Bearish

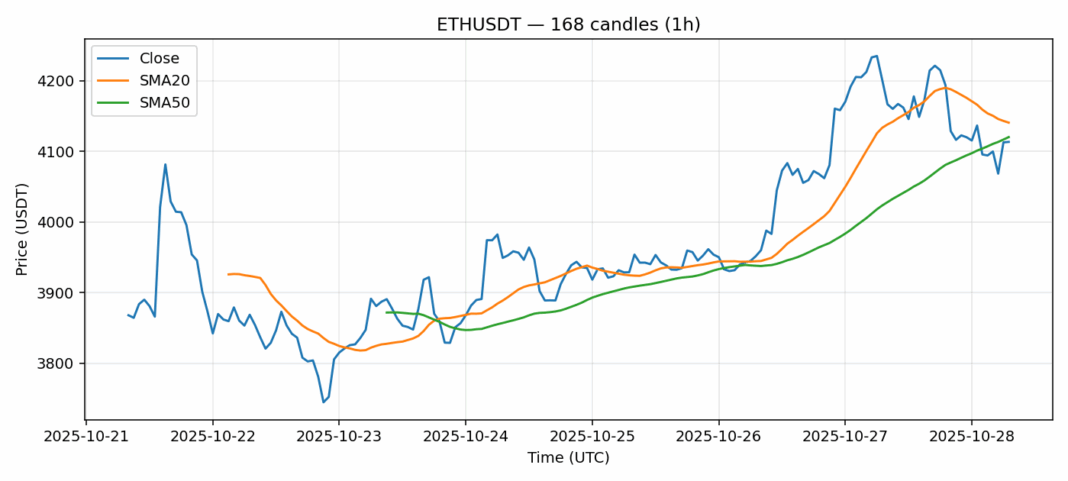

Ethereum faces a critical technical juncture as ETH/USDT hovers near $4,113, trading below both its 20-day SMA ($4,140) and 50-day SMA ($4,120). The -2.8% 24-hour decline reflects mounting selling pressure, though the oversold RSI reading of 29.6 suggests potential for a near-term relief rally. Current price action indicates consolidation below key moving averages, with elevated volatility at 3.07% highlighting market uncertainty. Trading volume remains substantial at $1.82 billion, signaling active institutional participation. Traders should watch for a decisive break above $4,150 resistance for bullish confirmation, while failure to hold $4,080 could trigger further downside toward $4,000 support. Position sizing remains crucial given current volatility conditions. Consider scaling into long positions only on confirmed bullish reversal patterns with tight stop-losses below $4,050.

Key Metrics

| Price | 4113.5600 USDT |

| 24h Change | -2.83% |

| 24h Volume | 1819950346.40 |

| RSI(14) | 29.60 |

| SMA20 / SMA50 | 4140.82 / 4120.33 |

| Daily Volatility | 3.08% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).