Sentiment: Bullish

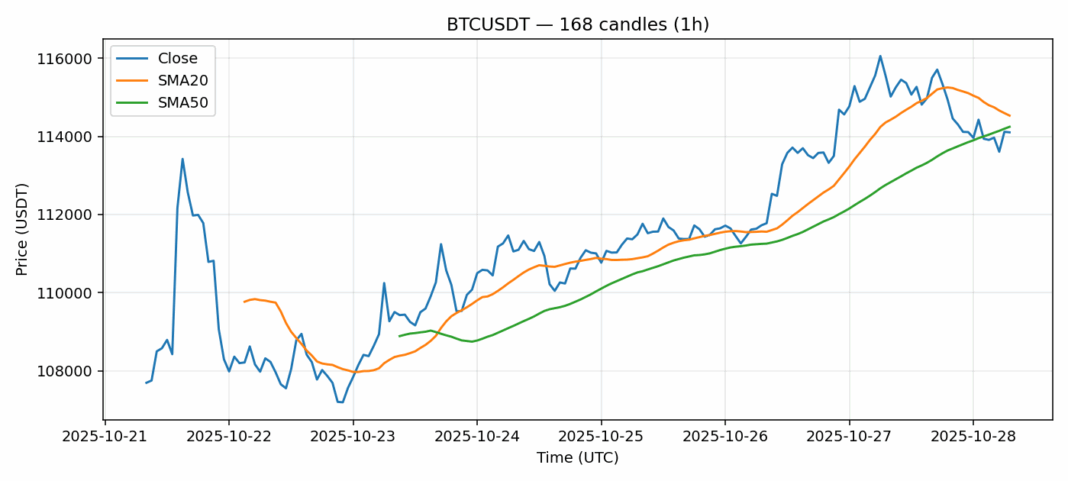

Bitcoin is currently trading at $114,100.95, showing modest 24-hour losses of 1.65% amid elevated volatility of 2.17%. The technical picture reveals significant oversold conditions with RSI plunging to 28.1, well below the traditional 30 oversold threshold. This extreme reading suggests potential for a near-term relief rally despite the current downward pressure. Price action finds itself sandwiched between the 20-day SMA at $114,529 and 50-day SMA at $114,243, indicating consolidation near key moving average support. Trading volume remains robust at $2.18 billion, suggesting institutional interest persists even during this corrective phase. For traders, current levels present potential accumulation opportunities with tight stop losses below $113,500. The oversold RSI combined with proximity to major moving averages creates a favorable risk-reward setup for tactical long positions targeting a retest of $116,000 resistance. However, the elevated volatility warrants position sizing discipline.

Key Metrics

| Price | 114100.9500 USDT |

| 24h Change | -1.65% |

| 24h Volume | 2176242597.87 |

| RSI(14) | 28.10 |

| SMA20 / SMA50 | 114529.71 / 114243.05 |

| Daily Volatility | 2.17% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).