Sentiment: Bullish

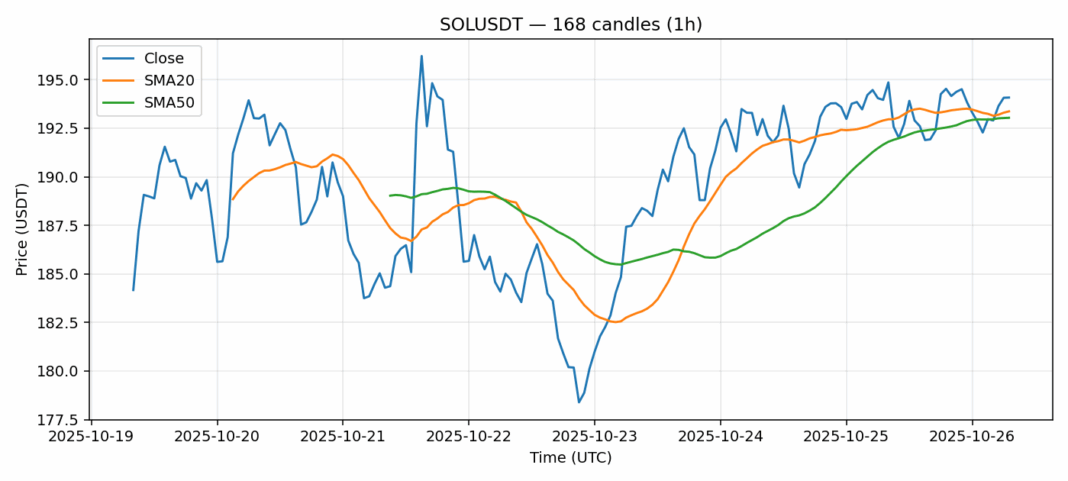

SOL is currently trading at $194.08, showing remarkable stability with zero price movement over the past 24 hours despite substantial trading volume of $286 million. The technical picture reveals SOL trading just above both its 20-day SMA ($193.37) and 50-day SMA ($193.04), indicating underlying strength. The RSI reading of 62 suggests the asset is approaching overbought territory but still has room for upward movement before hitting extreme levels. The current volatility of 3.46% reflects relatively calm market conditions compared to SOL’s typical price swings. For traders, the consolidation above key moving averages presents a potential accumulation opportunity, though the flat 24-hour performance warrants caution. Consider entering long positions with tight stops below $190, targeting resistance around $200. The substantial volume indicates institutional interest remains strong, supporting the case for continued upward momentum once this consolidation phase concludes.

Key Metrics

| Price | 194.0800 USDT |

| 24h Change | 0.00% |

| 24h Volume | 286550633.03 |

| RSI(14) | 62.07 |

| SMA20 / SMA50 | 193.37 / 193.04 |

| Daily Volatility | 3.46% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).