Sentiment: Neutral

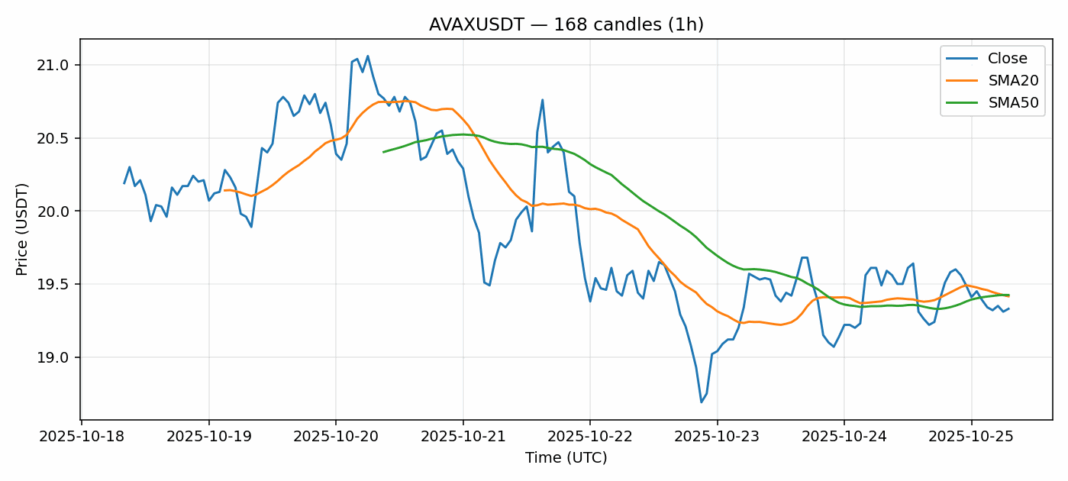

AVAX is showing consolidation patterns around the $19.33 level, trading slightly below both its 20-day ($19.42) and 50-day ($19.42) moving averages. The -1.43% 24-hour decline suggests mild selling pressure, though the RSI at 55.56 indicates neither overbought nor oversold conditions. Trading volume of $46.2 million demonstrates healthy market participation, while the 3.45% volatility reading suggests relatively stable price action compared to typical crypto standards. The convergence of SMAs creates a critical technical zone – a sustained break above $19.50 could trigger momentum buying toward $20.50 resistance. However, failure to hold $19 support may see a test of $18.50. Traders should watch for volume confirmation on any directional break and consider position sizing given the tight trading range. Options strategies like iron condors could capitalize on the contained volatility.

Key Metrics

| Price | 19.3300 USDT |

| 24h Change | -1.43% |

| 24h Volume | 46246700.90 |

| RSI(14) | 55.56 |

| SMA20 / SMA50 | 19.42 / 19.42 |

| Daily Volatility | 3.45% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).