Sentiment: Neutral

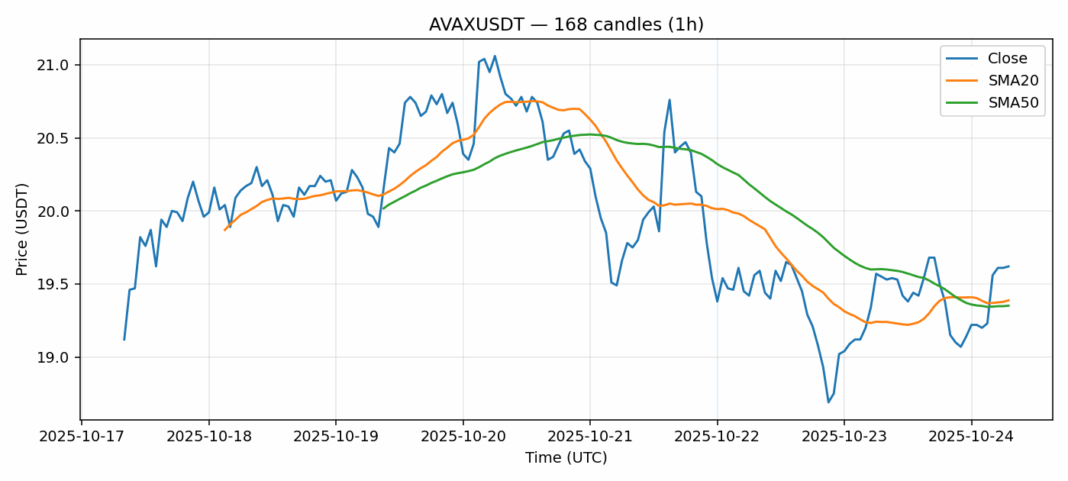

AVAX is showing consolidation patterns around the $19.60 level with modest 24-hour gains of 2.4%. The current price sits just above both the 20-day SMA ($19.39) and 50-day SMA ($19.35), suggesting potential support building at these levels. Trading volume of $53 million indicates moderate market participation, while the RSI reading of 47.5 shows neither overbought nor oversold conditions – positioning AVAX in neutral territory. The 3.66% volatility suggests relatively stable price action compared to typical crypto movements. Traders should watch for a decisive break above $20.00 resistance for bullish continuation, while a drop below the $19.30 support cluster could signal further downside. Consider scaling into positions on pullbacks toward the SMA confluence, with tight stops below $19.20 for risk management. The current setup favors range-bound trading until clearer directional momentum emerges.

Key Metrics

| Price | 19.6200 USDT |

| 24h Change | 0.46% |

| 24h Volume | 53060087.41 |

| RSI(14) | 47.50 |

| SMA20 / SMA50 | 19.39 / 19.35 |

| Daily Volatility | 3.66% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).