Sentiment: Bullish

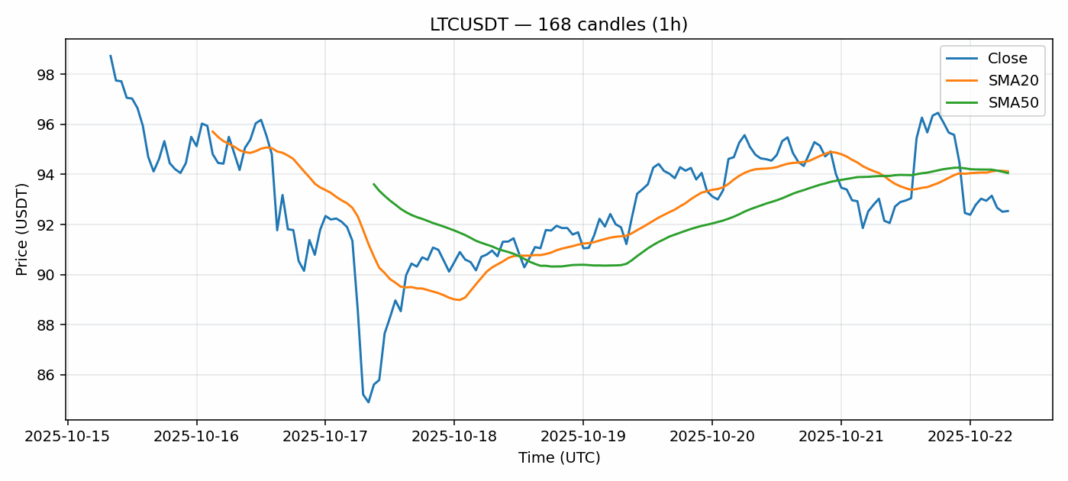

Litecoin is showing extreme oversold conditions with its RSI plunging to just 17, a level rarely seen in crypto markets that typically signals an imminent bounce. Despite trading at $92.54, LTC has dipped below both its 20-day ($94.12) and 50-day ($94.05) moving averages, suggesting near-term bearish momentum. The 24-hour trading volume of $57.8 million indicates moderate interest, while the -0.29% daily decline appears modest given the extreme technical readings. For traders, this presents a compelling risk-reward opportunity. Aggressive traders might consider scaling into long positions here with tight stops below $90, targeting a rebound toward $96-98 as the RSI normalizes. More conservative investors should wait for confirmation of a reversal pattern or a break above the $94.50 resistance level. The current volatility of nearly 4% suggests potential for sharp moves in either direction, so position sizing should remain disciplined.

Key Metrics

| Price | 92.5400 USDT |

| 24h Change | -0.29% |

| 24h Volume | 57847649.33 |

| RSI(14) | 16.98 |

| SMA20 / SMA50 | 94.12 / 94.05 |

| Daily Volatility | 3.91% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).