Sentiment: Bullish

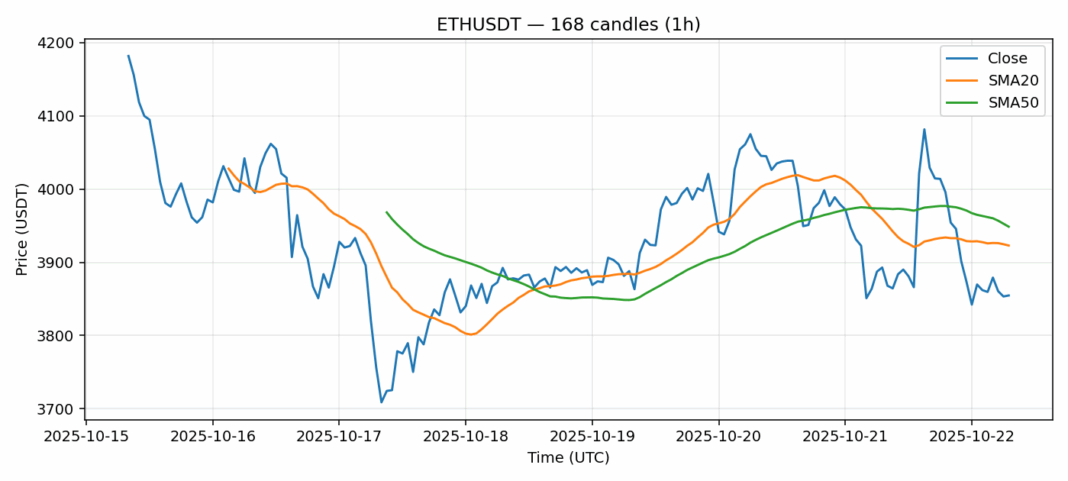

Ethereum is showing concerning technical signals as ETH/USDT trades at $3,854, down 0.79% over 24 hours. The most alarming indicator is the RSI reading of 18.86, which represents severely oversold conditions rarely seen in major cryptocurrencies. While price sits below both the 20-day SMA ($3,923) and 50-day SMA ($3,949), creating a bearish technical structure, the extreme RSI suggests potential for a significant bounce. Trading volume remains robust at $2.26 billion, indicating continued institutional interest despite the price weakness. The elevated 3.62% volatility underscores the current market uncertainty. For traders, this presents a classic contrarian opportunity – consider scaling into long positions with tight stop losses below $3,800. The risk-reward ratio favors buyers at these levels, though position sizing should remain conservative given the broader market pressures. Watch for a decisive break above the 20-day SMA as confirmation of trend reversal.

Key Metrics

| Price | 3854.7100 USDT |

| 24h Change | -0.79% |

| 24h Volume | 2255431998.79 |

| RSI(14) | 18.86 |

| SMA20 / SMA50 | 3922.93 / 3948.67 |

| Daily Volatility | 3.62% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).