Sentiment: Neutral

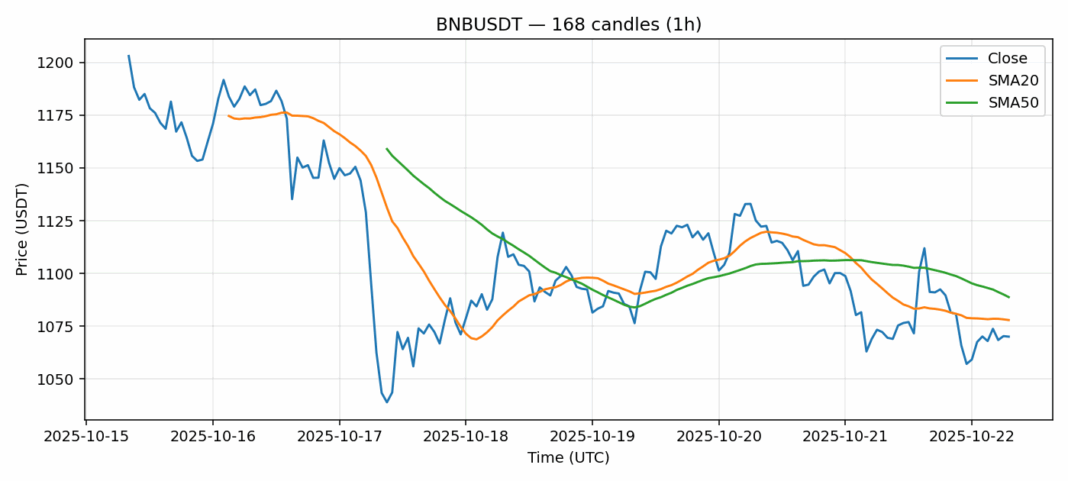

BNB is showing signs of potential exhaustion in its current downtrend, trading at $1,070 with a modest 0.23% decline over the past 24 hours. The technical picture reveals an oversold condition with RSI at 33.9, suggesting selling pressure may be nearing capitulation. Currently trading below both the 20-day SMA ($1,077.94) and 50-day SMA ($1,088.81), BNB faces immediate resistance around these levels. The $1,070 zone appears to be acting as temporary support, but sustained trading below the 20-day SMA indicates bearish momentum remains intact. Volume remains substantial at $541 million, suggesting institutional interest despite the price weakness. Traders should watch for a decisive break above $1,088 to confirm any reversal, while a breakdown below $1,060 could trigger further declines toward $1,040. Consider scaling into long positions on dips toward $1,060 with tight stops, while aggressive traders might short rallies toward the 20-day SMA resistance.

Key Metrics

| Price | 1070.0700 USDT |

| 24h Change | -0.23% |

| 24h Volume | 540991331.48 |

| RSI(14) | 33.91 |

| SMA20 / SMA50 | 1077.94 / 1088.81 |

| Daily Volatility | 4.16% |

BNB — 1h candles, 7D window (SMA20/SMA50, RSI).