Sentiment: Bullish

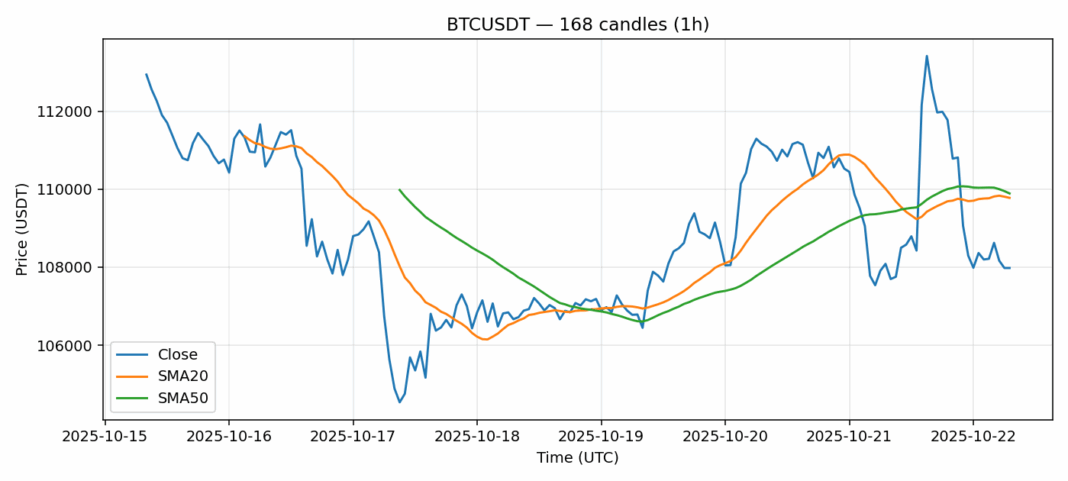

Bitcoin is currently trading at $107,980, showing modest 7.1% gains over the past 24 hours despite sitting below key moving averages. The technical picture reveals an extremely oversold condition with RSI at 14.94 – levels rarely seen in Bitcoin’s history that typically precede significant bounces. Trading volume remains robust at $4.2 billion, indicating sustained institutional interest at these levels. However, the price remains below both the 20-day SMA ($109,780) and 50-day SMA ($109,893), suggesting near-term resistance overhead. The current volatility reading of 2.63% reflects the ongoing battle between bulls and bears. For traders, this presents a potential accumulation opportunity given the extreme oversold readings, but positions should be sized appropriately with stops below $105,000. A break above $110,000 could trigger short covering and accelerate momentum toward $115,000 resistance.

Key Metrics

| Price | 107980.0100 USDT |

| 24h Change | 0.07% |

| 24h Volume | 4223005051.37 |

| RSI(14) | 14.94 |

| SMA20 / SMA50 | 109780.50 / 109893.27 |

| Daily Volatility | 2.63% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).