Sentiment: Neutral

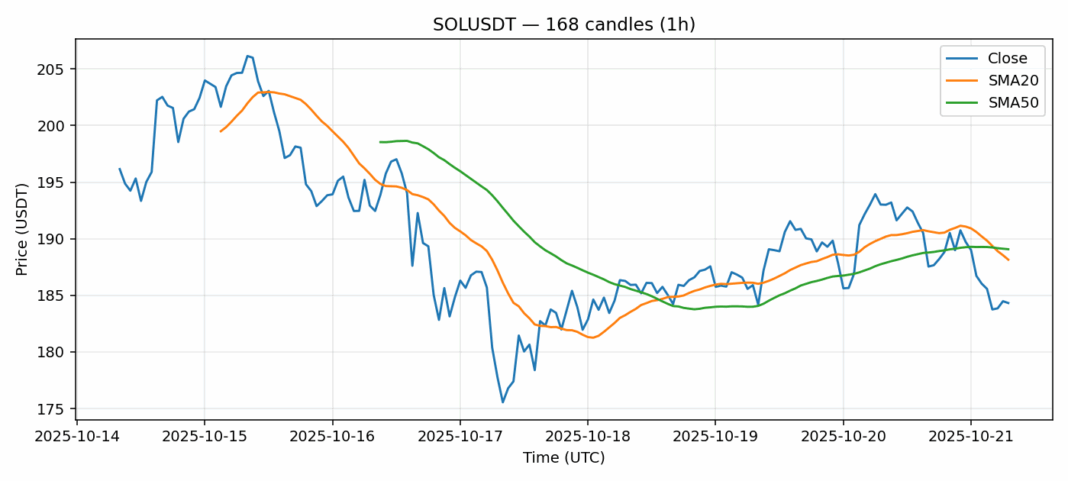

SOL faces a critical technical juncture after sliding 4.8% to $184.32, now trading below both its 20-day ($188.15) and 50-day ($189.07) SMAs. The RSI reading of 38 suggests we’re approaching oversold territory, though not there yet. Daily volume remains robust at $581M, indicating significant trader interest at these levels. The 4.36% volatility reading shows SOL remains highly responsive to market moves. For traders, this presents a potential accumulation opportunity – the convergence of support near current prices with improving RSI dynamics could signal a near-term bounce. However, maintain strict risk management with stops below $175. A decisive break above the SMA cluster around $188-189 would confirm bullish momentum resumption, while failure to hold $180 could trigger further downside toward $170. Given the technical setup, scaling into positions makes sense here rather than going all-in.

Key Metrics

| Price | 184.3200 USDT |

| 24h Change | -4.82% |

| 24h Volume | 581335456.81 |

| RSI(14) | 38.07 |

| SMA20 / SMA50 | 188.15 / 189.07 |

| Daily Volatility | 4.36% |

Solana — 1h candles, 7D window (SMA20/SMA50, RSI).