Sentiment: Neutral

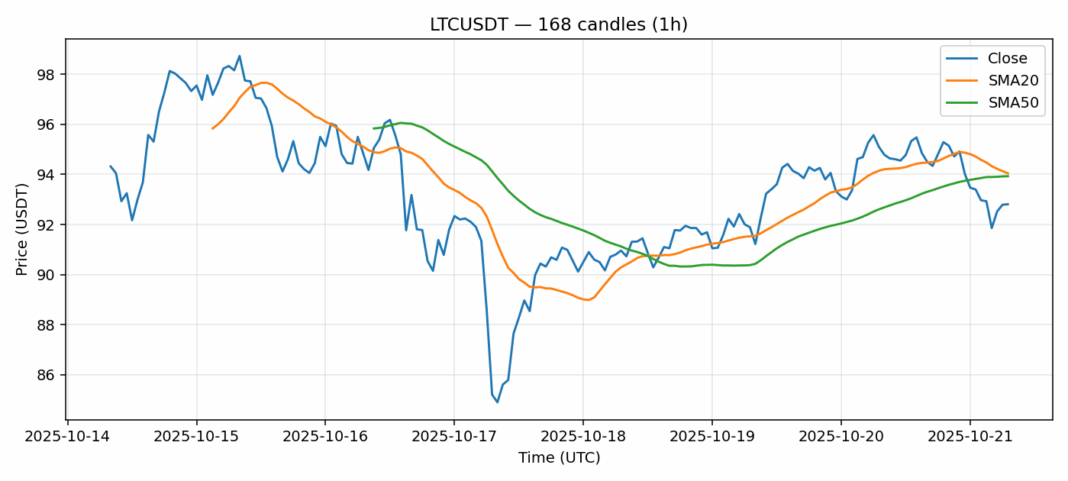

LTCUSDT is showing signs of potential accumulation after a 2.65% decline to $92.80, with the RSI reading of 36.65 approaching oversold territory. The current price sits just below both the 20-day SMA ($94.05) and 50-day SMA ($93.93), indicating near-term bearish pressure but with key support levels nearby. Trading volume remains healthy at $35.8 million, suggesting continued market interest despite the pullback. The 3.88% volatility reading indicates moderate price swings, typical for Litecoin during consolidation phases. For traders, this setup suggests potential buying opportunities for those with a medium-term horizon, though strict risk management is advised. Consider entering long positions near $90-92 support with stops below $88, targeting a retest of the $96-98 resistance zone. Short-term traders might wait for a confirmed break above the 20-day SMA before adding exposure.

Key Metrics

| Price | 92.8000 USDT |

| 24h Change | -2.65% |

| 24h Volume | 35809344.09 |

| RSI(14) | 36.65 |

| SMA20 / SMA50 | 94.05 / 93.93 |

| Daily Volatility | 3.88% |

Litecoin — 1h candles, 7D window (SMA20/SMA50, RSI).