Sentiment: Bearish

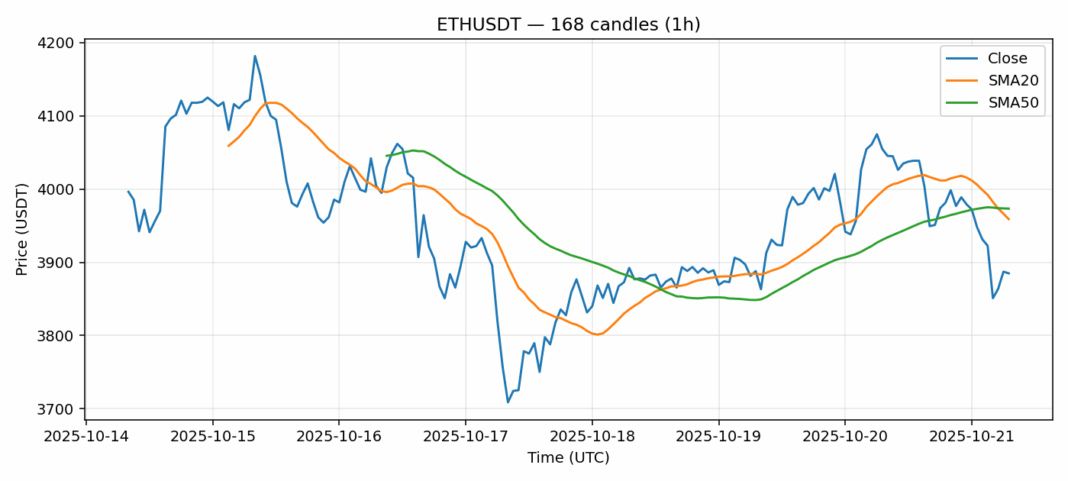

Ethereum faces significant selling pressure as ETH/USDT trades at $3,885, down 4.6% over the past 24 hours. The current price sits below both the 20-day SMA ($3,959) and 50-day SMA ($3,973), indicating bearish momentum in the short to medium term. With RSI reading at 37.17, ETH is approaching oversold territory but hasn’t reached extreme levels yet. The elevated volatility of 3.4% suggests continued price swings ahead. Trading volume remains substantial at $1.9 billion, confirming active participation in this downturn. For traders, consider waiting for RSI to drop below 30 for potential long entries, with strict stop losses below $3,800. Resistance appears strong around the $3,950-$4,000 zone where the moving averages converge. Short-term traders might find opportunities in volatility plays, but position sizing should remain conservative given the current bearish technical structure.

Key Metrics

| Price | 3885.1000 USDT |

| 24h Change | -4.60% |

| 24h Volume | 1901755631.85 |

| RSI(14) | 37.17 |

| SMA20 / SMA50 | 3958.96 / 3973.35 |

| Daily Volatility | 3.42% |

Ethereum — 1h candles, 7D window (SMA20/SMA50, RSI).