Sentiment: Neutral

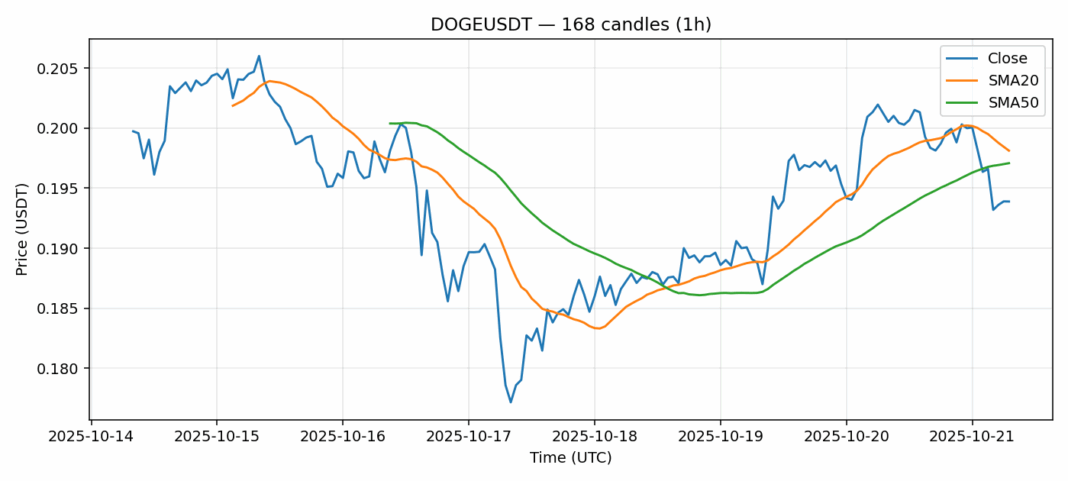

DOGE is showing signs of capitulation after a 3.7% daily decline, with price currently testing key support near $0.193. The RSI reading of 33.5 indicates oversold conditions, historically presenting potential entry opportunities for contrarian traders. However, DOGE remains below both its 20-day ($0.198) and 50-day ($0.197) SMAs, suggesting the broader trend remains bearish. The elevated 4.18% volatility combined with substantial $202M daily volume indicates significant market participation at these levels. For traders, consider scaling into long positions with tight stops below $0.190, targeting a rebound toward the SMA cluster around $0.197-0.198. Risk management is crucial given the meme coin’s notorious volatility – position sizing should reflect the elevated risk profile. Watch for volume confirmation on any upward moves to validate potential trend reversal.

Key Metrics

| Price | 0.1939 USDT |

| 24h Change | -3.69% |

| 24h Volume | 202281040.78 |

| RSI(14) | 33.54 |

| SMA20 / SMA50 | 0.20 / 0.20 |

| Daily Volatility | 4.18% |

Dogecoin — 1h candles, 7D window (SMA20/SMA50, RSI).