Sentiment: Neutral

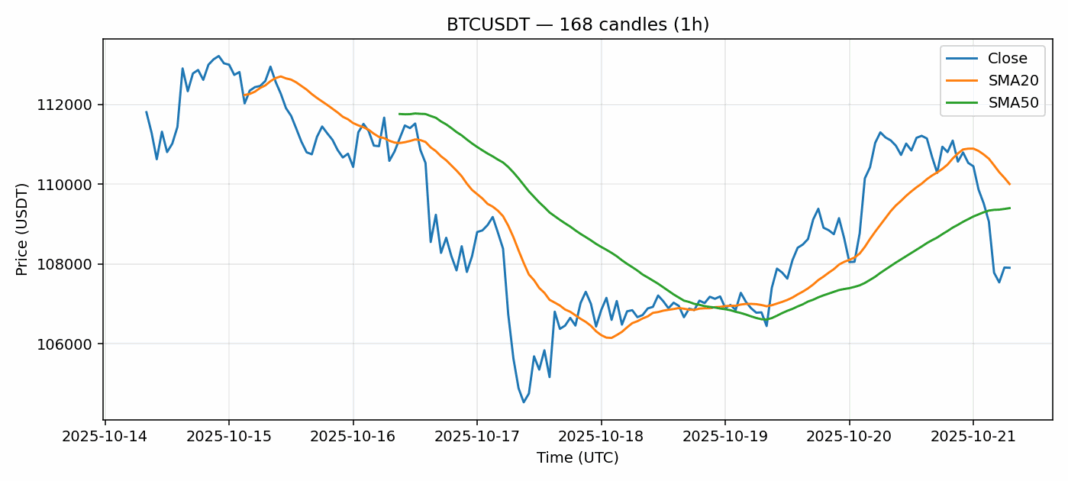

Bitcoin is currently trading at $107,903 after experiencing a 3% pullback over the past 24 hours. The cryptocurrency finds itself in technically oversold territory with an RSI reading of 28, suggesting potential for a near-term bounce. However, BTC remains trading below both its 20-day SMA ($110,003) and 50-day SMA ($109,398), indicating persistent bearish momentum in the medium term. The elevated volatility reading of 2.2% reflects ongoing market uncertainty, though the substantial $2.1 billion in 24-hour trading volume shows continued institutional interest at these levels. For traders, current levels present a potential accumulation opportunity for those with longer time horizons, but strict stop-losses around $105,000 are advisable given the downward momentum. Short-term traders might consider waiting for a confirmed break above the 20-day SMA before entering long positions. The oversold RSI condition suggests we could see consolidation or a relief rally in the coming sessions.

Key Metrics

| Price | 107903.6200 USDT |

| 24h Change | -3.03% |

| 24h Volume | 2101267264.63 |

| RSI(14) | 28.26 |

| SMA20 / SMA50 | 110003.14 / 109398.29 |

| Daily Volatility | 2.20% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).