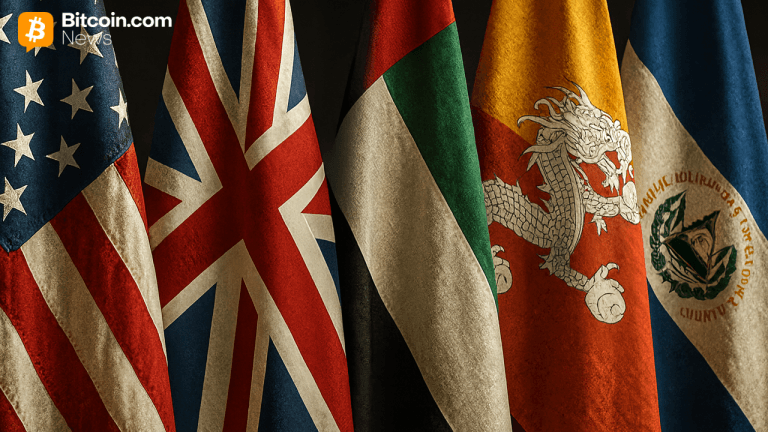

The United States has established itself as the dominant governmental holder of bitcoin globally, with confirmed reserves exceeding 127,000 BTC. This strategic accumulation positions Washington at the forefront of national digital asset adoption, reflecting a calculated approach to cryptocurrency reserves management.

Multiple sovereign states have initiated systematic bitcoin acquisition programs, creating substantial national treasuries in the world’s premier cryptocurrency. The United Kingdom has emerged as another significant participant in this space, implementing measured procurement strategies that complement traditional reserve assets.

Current data through October 19, 2025, reveals coordinated efforts among leading economies to build cryptocurrency positions through various acquisition channels. These sovereign digital asset portfolios represent billions in value, demonstrating institutional recognition of bitcoin’s potential role in modern treasury management.

Government bitcoin reserves now constitute a meaningful segment of the overall cryptocurrency market, with national strategies varying from direct purchases to judicial seizures and regulatory settlements. This trend indicates growing acceptance of digital assets at the sovereign level, with careful consideration given to security protocols, custody solutions, and long-term valuation prospects.

The evolving landscape of national cryptocurrency holdings suggests a fundamental shift in how governments perceive and interact with digital assets, potentially signaling broader institutional adoption in global financial systems.