Sentiment: Bullish

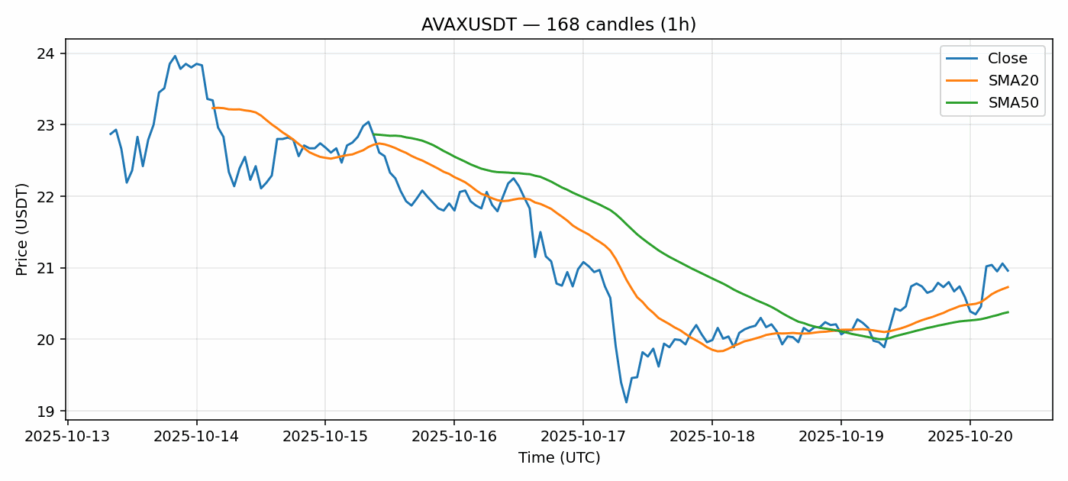

AVAX is showing encouraging momentum, trading at $20.96 with a solid 5.06% gain over the past 24 hours. The current price sits comfortably above both the 20-day SMA ($20.73) and 50-day SMA ($20.38), indicating underlying strength in the medium-term trend. Volume has been robust at over $62 million, suggesting genuine institutional and retail interest rather than speculative froth. The RSI reading of 57.69 places AVAX in neutral territory with slight bullish bias, leaving ample room for upward movement before reaching overbought conditions. With volatility at 4.6%, traders should expect continued price swings but within manageable ranges. For position traders, consider accumulating on dips toward the $20.50 support level with stops below $19.80. Short-term traders might target resistance around $21.50-$22.00, though be prepared for potential profit-taking at these levels given the recent run-up.

Key Metrics

| Price | 20.9600 USDT |

| 24h Change | 5.06% |

| 24h Volume | 62173751.52 |

| RSI(14) | 57.69 |

| SMA20 / SMA50 | 20.73 / 20.38 |

| Daily Volatility | 4.60% |

Avalanche — 1h candles, 7D window (SMA20/SMA50, RSI).