Sentiment: Neutral

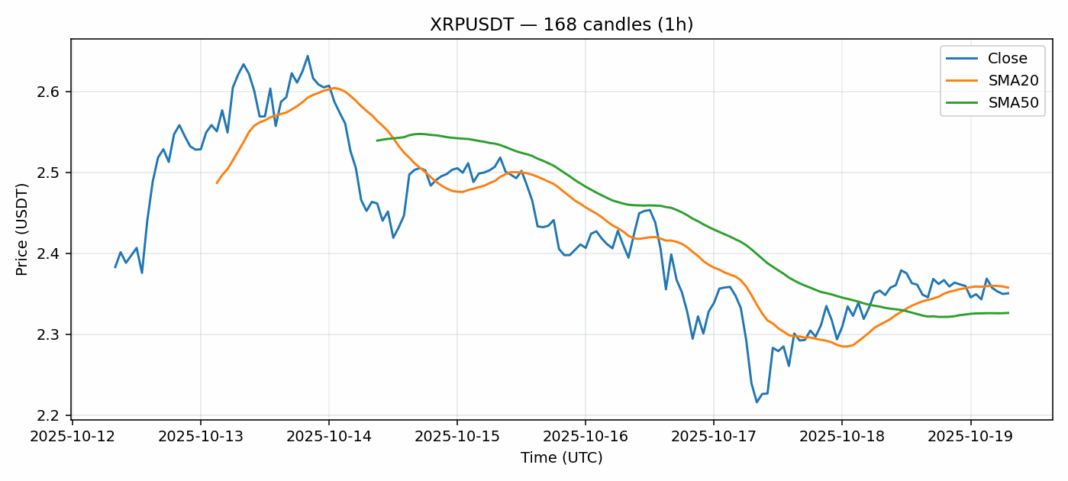

XRP is showing mixed signals as it trades at $2.35, slightly below its 20-day SMA of $2.36 but holding above the 50-day SMA of $2.33. The 24-hour decline of 2.6% suggests short-term pressure, though the RSI reading near 41 indicates the asset is approaching oversold territory, potentially setting up for a rebound. Trading volume remains robust at nearly $150 million, providing adequate liquidity for larger moves. With volatility at 4.16%, traders should expect continued price swings in the near term. The key support to watch is the $2.33 level (50-day SMA), which if broken could trigger further downside toward $2.25. Resistance sits at the $2.40-2.45 zone. Given the technical setup, cautious accumulation on dips toward support appears prudent, with tight stops below $2.30 for risk management. The overall structure suggests consolidation before the next directional move.

Key Metrics

| Price | 2.3504 USDT |

| 24h Change | -0.03% |

| 24h Volume | 149443941.90 |

| RSI(14) | 40.90 |

| SMA20 / SMA50 | 2.36 / 2.33 |

| Daily Volatility | 4.16% |

Ripple — 1h candles, 7D window (SMA20/SMA50, RSI).