Sentiment: Neutral

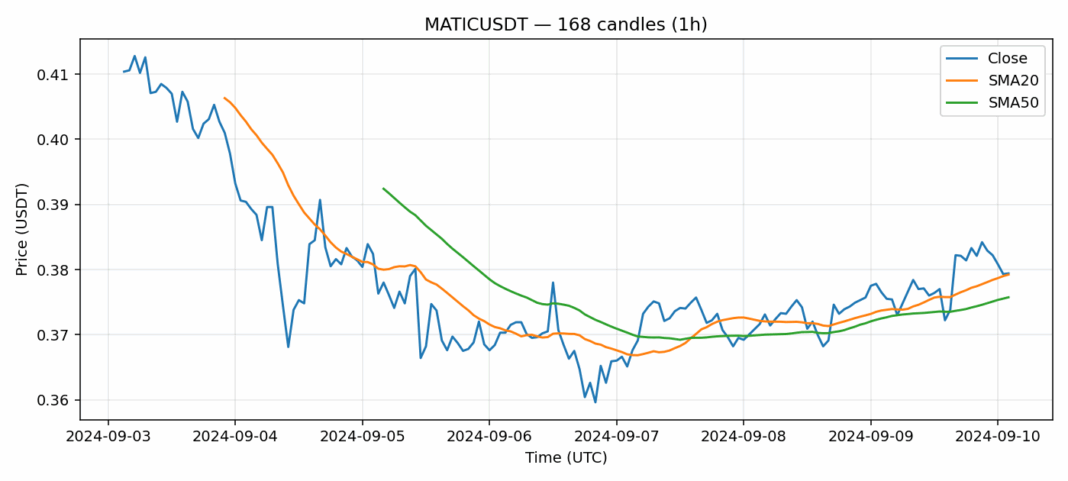

MATIC is showing consolidation around the $0.379 level with minimal deviation from its 20-day SMA at $0.37922, indicating strong near-term support. The 24-hour decline of 0.289% appears more as healthy profit-taking than structural weakness, particularly given its position above the 50-day SMA at $0.37573. RSI at 55.68 suggests balanced momentum without overbought pressure, while moderate volatility of 3.84% provides adequate swing trading opportunities. The $107M daily volume demonstrates sustained institutional interest despite the minor pullback. Traders should watch for a decisive break above $0.385 for bullish continuation toward $0.40 resistance, with downside protection at the 50-SMA level. Accumulation on dips toward $0.375 seems prudent given the technical foundation, though position sizing should account for broader market sentiment given MATIC’s correlation with Ethereum ecosystem developments.

Key Metrics

| Price | 0.3794 USDT |

| 24h Change | -0.29% |

| 24h Volume | 1074370.70 |

| RSI(14) | 55.68 |

| SMA20 / SMA50 | 0.38 / 0.38 |

| Daily Volatility | 3.84% |

Polygon — 1h candles, 7D window (SMA20/SMA50, RSI).