Sentiment: Neutral

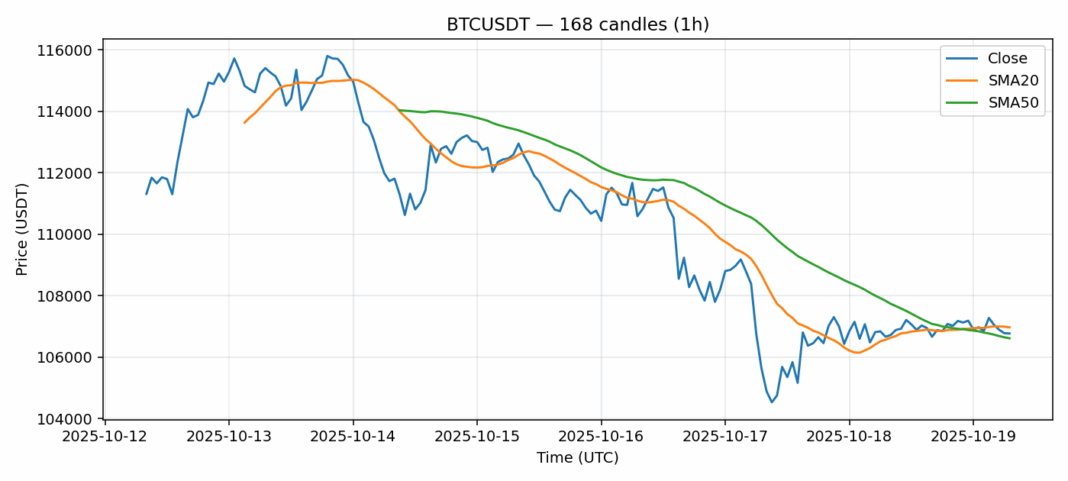

Bitcoin is currently trading at $106,777, showing modest weakness with a 0.06% decline over the past 24 hours. The price finds itself in a technical consolidation phase, sitting between the 20-day SMA at $106,969 and the 50-day SMA at $106,612. This positioning suggests the market is at a critical inflection point. The RSI reading of 47.29 indicates neutral momentum with a slight bearish tilt, while volatility remains elevated at 2.2%, reflecting ongoing uncertainty among traders. Volume data shows healthy activity at $954 million, suggesting institutional interest remains despite the sideways movement. For traders, the current setup presents a classic range-bound opportunity. Consider buying near the 50-day SMA support with tight stops below $106,500, while resistance at the 20-day SMA offers potential short entries. The narrow trading range between moving averages suggests an imminent breakout is likely – position accordingly with defined risk parameters.

Key Metrics

| Price | 106777.7400 USDT |

| 24h Change | -0.06% |

| 24h Volume | 954690336.59 |

| RSI(14) | 47.29 |

| SMA20 / SMA50 | 106969.15 / 106612.81 |

| Daily Volatility | 2.20% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).