Sentiment: Neutral

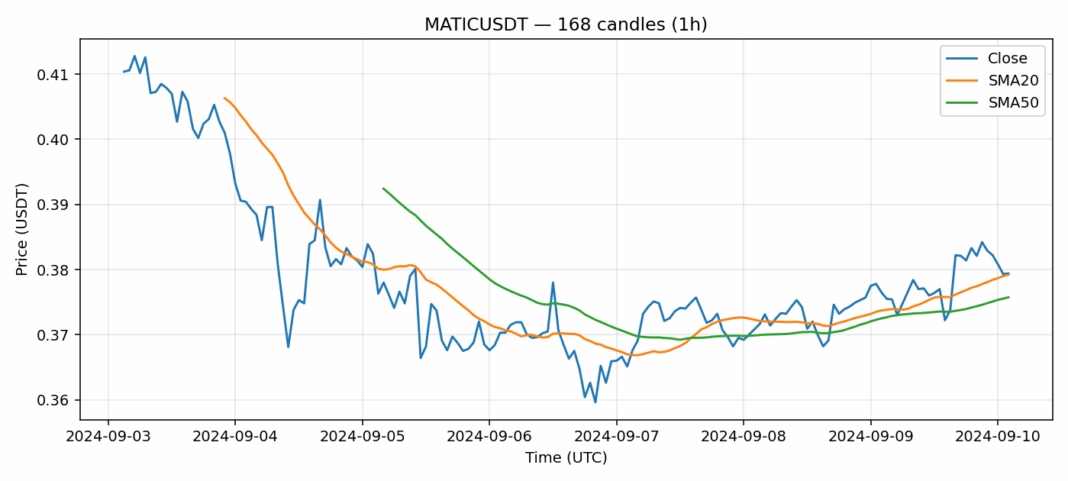

MATIC is showing consolidation around the $0.379 level after a modest 24-hour decline of 0.29%. Trading volume remains healthy at $1.07 million, indicating sustained market interest. The RSI at 55.68 suggests neutral momentum with slight bullish bias, while price action hovering just above both the 20-day SMA ($0.37922) and 50-day SMA ($0.37573) indicates underlying support strength. Current volatility of 3.84% reflects typical consolidation patterns. For traders, holding above $0.375 provides a solid foundation for potential upward movement toward $0.39 resistance. Consider accumulating on dips toward the SMA support zone with stops below $0.372. The technical setup favors range-bound trading with bullish potential if volume increases during upward moves. Monitor broader market sentiment as MATIC appears poised for directional breakout once consolidation completes.

Key Metrics

| Price | 0.3794 USDT |

| 24h Change | -0.29% |

| 24h Volume | 1074370.70 |

| RSI(14) | 55.68 |

| SMA20 / SMA50 | 0.38 / 0.38 |

| Daily Volatility | 3.84% |

Polygon — 1h candles, 7D window (SMA20/SMA50, RSI).