Sentiment: Neutral

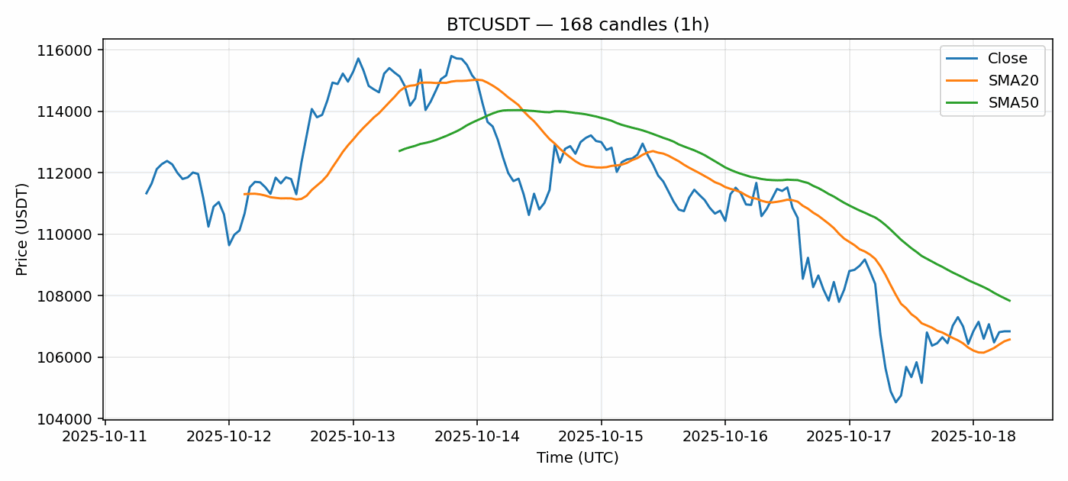

Bitcoin continues to consolidate around the $106,800 level, showing modest 8.2% gains over the past 24 hours with healthy trading volume exceeding $3.7 billion. The current technical picture presents a mixed but cautiously optimistic outlook. BTC is trading slightly above its 20-day SMA of $106,573, indicating near-term support, though it remains below the 50-day SMA at $107,836, suggesting some resistance overhead. The RSI reading of 54 sits in neutral territory, neither overbought nor oversold, providing room for potential movement in either direction. The 2.3% volatility reading suggests relatively stable conditions for Bitcoin. Traders should watch for a decisive break above the $107,800 level, which could trigger momentum toward $110,000. Conversely, failure to hold above $106,500 could see a retest of support around $105,000. Position sizing should remain conservative until clearer directional momentum emerges.

Key Metrics

| Price | 106839.9700 USDT |

| 24h Change | 0.08% |

| 24h Volume | 3778899444.95 |

| RSI(14) | 54.03 |

| SMA20 / SMA50 | 106573.47 / 107836.78 |

| Daily Volatility | 2.31% |

Bitcoin — 1h candles, 7D window (SMA20/SMA50, RSI).