Sentiment: Bearish

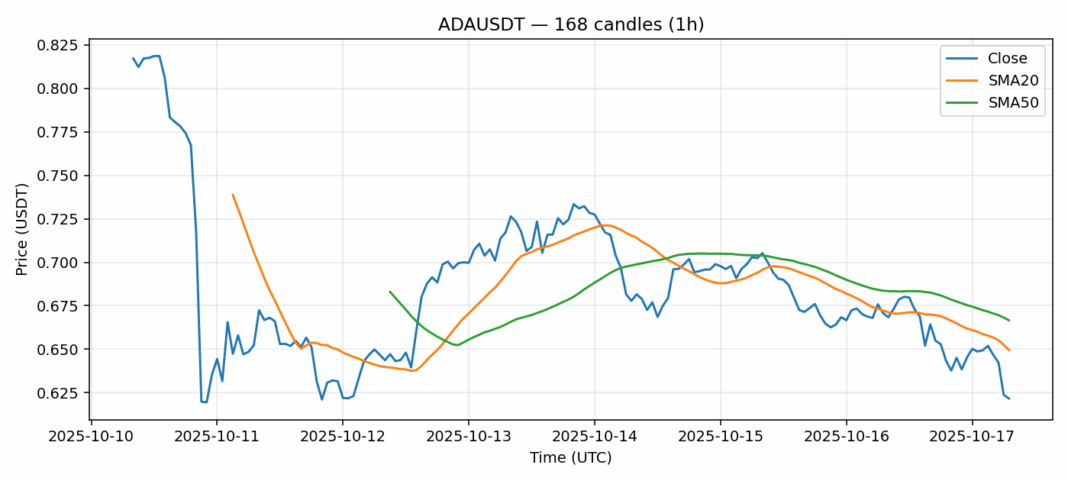

ADA is showing significant technical weakness as it trades at $0.6218, down over 8% in the past 24 hours amid heavy selling pressure. The RSI reading of 28.77 indicates the asset is deeply oversold, approaching levels that have historically preceded bounces. However, ADA remains below both its 20-day SMA ($0.6495) and 50-day SMA ($0.6666), confirming the bearish momentum remains intact. The elevated 8.3% volatility suggests continued uncertainty, though the substantial $144 million trading volume indicates institutional interest at these levels. For traders, this presents a classic contrarian opportunity – consider scaling into long positions with tight stops below $0.60, targeting a rebound toward the $0.65 resistance zone. More conservative investors should wait for a confirmed break above the 20-day SMA before entering, as the current trend remains downward despite oversold conditions.

Key Metrics

| Price | 0.6218 USDT |

| 24h Change | -8.04% |

| 24h Volume | 144095300.23 |

| RSI(14) | 28.77 |

| SMA20 / SMA50 | 0.65 / 0.67 |

| Daily Volatility | 8.34% |

Cardano — 1h candles, 7D window (SMA20/SMA50, RSI).